Members of the U.S. Congress have sent a letter to the Internal Revenue Service (IRS) urging the agency to provide more clarity about crypto tax. In October, the IRS published tax guidance for anyone operating in the crypto industry, addressing multiple concerns of the cryptorati.

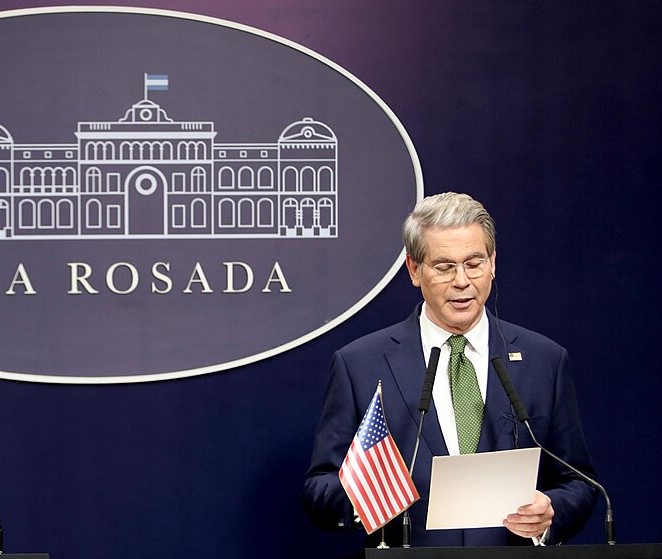

Although the agency managed to answer some inquiries, the guidance wasn’t as extensive as people hoped, leaving more questions in the air. Overall, eight congressmen signed the letter, including Representative Tom Emmer, Darren Soto, Bill Foster, and David Schweikert.

These four are members of the Congressional Blockchain Caucus, a group of policymakers who are advocating for blockchain technology and cryptocurrency, CoinDesk reported. In the letter, the congressmen pointed out that the IRS used hypothetical scenarios that don’t mirror what’s been unfolding in the crypto scene.

Guidance on forks and airdrops

“The hypothetical fact patterns concerning forks and airdrops offered in this guideline do not appear to bear a close resemblance to actual forks or airdrops as they have occurred in the cryptocurrency ecosystem. Without clear and accurate hypotheticals for taxpayers to measure against, it is difficult to interpret IRS policy as it relates to actual events,” the letter read.

The letter also highlighted the IRS’ approach on forks and airdrops, pointing out that the current position of the agency exposes people to unwanted tax liabilities. The IRS declares that crypto holders have “dominion and control” about forks and airdrops even if they have no knowledge about the occurrence of both.

There’s also the concern regarding the IRS’ declaration of the guidance being “established law,” which transforms it into a rigid baseline. The crypto industry is an evolving market and is subject to massive changes over time.

An urgent question

The lawmakers recognize this and urge the IRS to take a flexible approach towards the crypto space. At the end of the letter, the congressmen provided three questions for the IRS to answer, with the most urgent being:

“Does the IRS intend to clarify its airdrop and fork hypotheticals to better match the actual nature of these events within the cryptocurrency ecosystem? When does the IRS anticipate issuing such clarification?”

With tax season just around the corner, it’s imperative that the IRS provides clear guidelines about these concerns to counsel people accordingly. Although there are services already available to ease the taxpayers’ burden, this clarification is still needed to avoid confusion.

Comment 0