The U.S. Internal Revenue Services has released new guidance in the form of a Revenue Ruling for tax reporting on cryptocurrency airdrops and hard forks.

The Revenue Ruling 2019-24 intends to help taxpayers understand reporting obligations for specific transactions that involve cryptocurrencies. Particularly, it addresses tax liabilities created by cryptocurrency forks, the acceptable methods for declaring crypto received as income, and how to determine tax gains when selling cryptos.

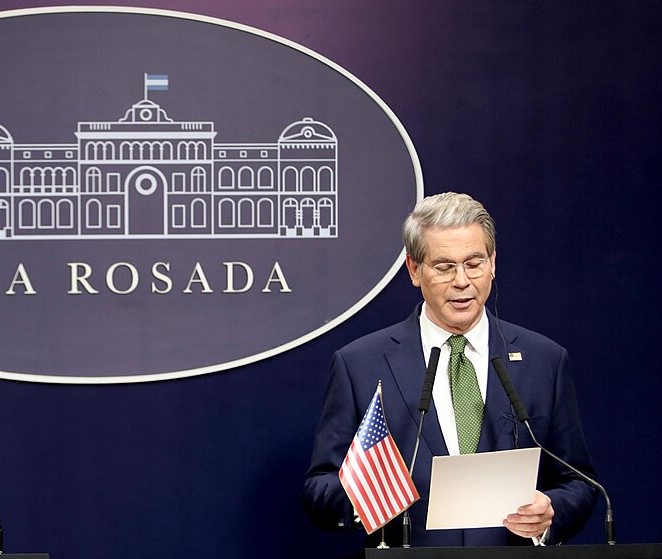

“The new guidance will help taxpayers and tax professionals better understand how longstanding tax principles apply in this rapidly changing environment,” Chuck Rettig, IRS Commissioner, said.

“We want to help taxpayers understand the reporting requirements as well as take steps to ensure fair enforcement of the tax laws for those who don’t follow the rules.”

The recent guideline specifically addresses two questions:

- Does a taxpayer have gross income under §61 of the Internal Revenue Code (Code) as a result of a hard fork of a cryptocurrency the taxpayer owns if the taxpayer does not receive units of a new cryptocurrency?

- Does a taxpayer have gross income under §61 as a result of an airdrop of a new cryptocurrency following a hard fork if the taxpayer receives units of new cryptocurrency?

Based on the ruling, the first questioned should be answered with a “no,” given the fact that the taxpayer did not receive the cryptocurrency and so does not have “an accession to wealth” and attributable gross income. On the other hand, the answer to the second question is “yes,” where the taxpayers “receive” the cryptocurrency.

The Block noted that there is some vagueness to the new guidance, such as what receiving cryptocurrency actually means. It can also pose a risk of tax liability on cryptos that were neither actually received nor easily liquidated.

The new guidance is an addition to Notice 2014-21, which sets “general principles of tax law to determine that virtual currency is property for federal tax purposes.”

It can be recalled in August that the IRS sent out another round of letters to crypto holders, stating the amount the office believes the taxpayers owe, after carrying out its own investigation from third parties.

Comment 0