Crypto market aggregator CoinGecko has announced that it has upgraded its “Trust Score” metric, which aims to bring a more robust exchange ranking system.

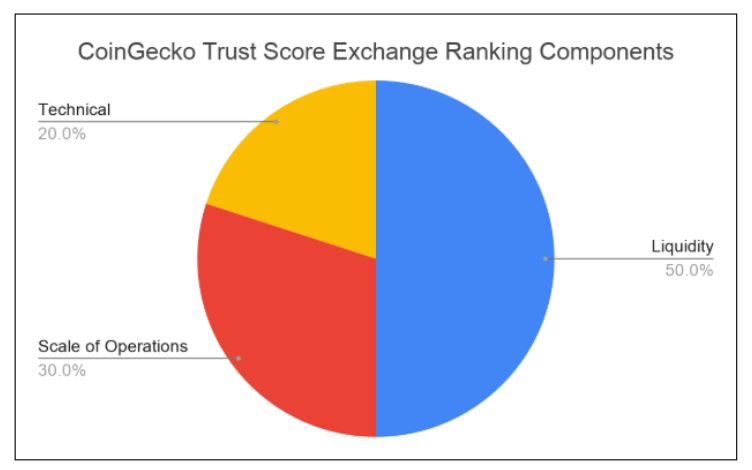

As per a press release, the new upgrade, called Trust Score 2.0, will go beyond liquidity measurements and look at four additional major measurements, including exchanges’ API technical coverage, the scale of operations, estimated cryptocurrency reserves, and regulatory compliance.

CoinGecko Co-Founder TM Lee said that following the new launch, “progress is being made to promote transparency amongst cryptocurrency exchanges. We look forward to innovating further to better evaluate cryptocurrency exchanges based on a comprehensive set of data.”

After the new scoring system went live, CoinGecko named Binance, Bitfinex, Bittrex, Poloniex, and Coinbase Pro as the top five crypto exchanges based on its metrics.

“Cryptocurrency Reserves and Regulatory Compliance categories are not included in the overall Trust Score 2.0 calculations for now but are considered candidates for inclusion in future Trust Score algorithm updates,” the company stated in the post.

CoinGecko has collaborated with Bitfury’s Crystal blockchain to carry out on-chain analysis of the bitcoin, ethereum, and bitcoin cash reserves of exchanges. It also partnered with Coinfirm’s AMLT Network to analyze the exchanges’ regulatory compliance.

“With the introduction of Trust Score 2.0, the market can now leverage CoinGecko’s extensive dataset for a ‘360 degree view’ of both cryptocurrencies and exchanges.We believe that the best way for the market to grow is to be transparent and to empower cryptocurrency traders with data that helps them make better informed decisions,” the firm stated.

Speaking to CoinDesk, CoinGecko Co-founder Bobby Ong said that the firm has seen a growth of 706% in the number of exchanges it is tracking, up from just 45 to 363 exchanges now.

CoinGecko launched Trust Score earlier in May to offer additional insights into the liquidity of exchanges through order book and web traffic analysis. The initiative aims to fight fake and manipulated exchange volumes and to help investors avoid exchanges with poor actual liquidity.

Comment 0