New York — The world’s biggest financial institutions are no longer talking about blockchain in theory — they’re building on it.

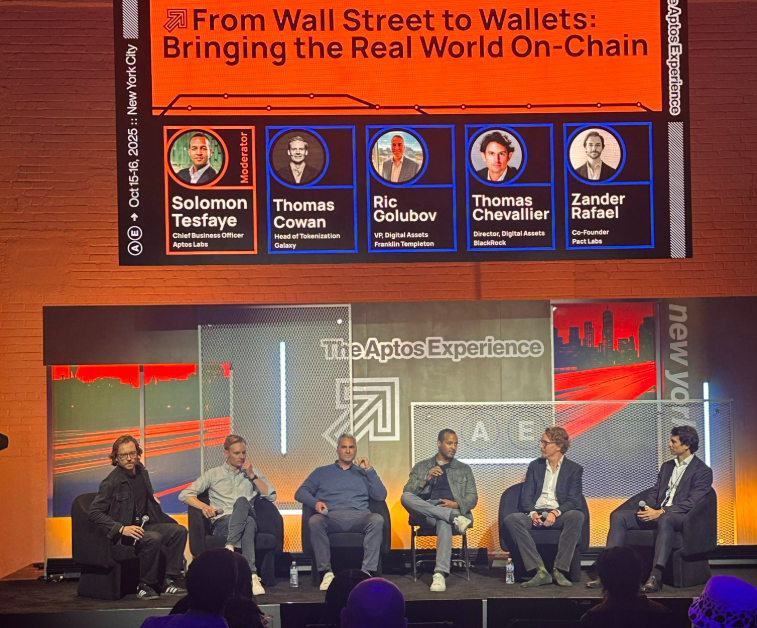

At Aptos Experience 2025 in New York, leaders from BlackRock, Franklin Templeton, Galaxy, and Pact Labs said that the tokenization of real-world assets (RWA) is moving from pilot projects to production-scale finance.

The panel, titled “From Wall Street to Wallets: Bringing the Real World On-Chain,” featured Thomas Chevallier of BlackRock, Ric Golubov of Franklin Templeton, Thomas Cowan of Galaxy, and Alexander Rafael of Pact Labs, moderated by Solomon Tesfaye, Chief Business Officer at Aptos Labs.

Alexander Rafael of Pact Labs said his firm had tokenized $1.8 billion in credit assets over the past nine months. “We connect borrowers directly to buyers through on-chain rails. When you remove contracts and intermediaries, borrowing costs fall for everyone,” he said.

Galaxy’s Cowan highlighted the structural impact: “Putting structured debt products on-chain turns multi-day settlement into instant clearing. You get transparency, secondary liquidity, and lower origination costs — that’s the core economic case.”

Franklin Templeton’s Golubov compared tokenization to the rise of ETFs. “ETFs transformed access to capital markets thirty years ago; tokenization is doing the same today,” he said. The firm’s Benji fund — a tokenized U.S. government money market fund live on nine public blockchains — now delivers “real-time yield, instant transfers, and peer-to-peer distribution.”

BlackRock’s Chevallier called tokenization “the next operating system for capital markets.” He cited roughly $4 trillion in tokenized capital today, with “multiples of that” in pipeline potential. But he warned that “compliance, identity, and on-chain KYC are the key friction points before true democratization of finance can occur.”

Moderator Tesfaye framed the discussion within Aptos’ broader mission: “Digital wallets are growing faster than the internet did in its first decade. We’re not just building fast blockchains — we’re building the rails for real-world finance.”

As the discussion closed, the panelists agreed on one prediction: in five years, “no one will say tokenization anymore — they’ll just say assets.”

Comment 0