MicroStrategy (MSTR), now rebranded as “Strategy,” continues to make waves as the face of the corporate bitcoin treasury movement. With earnings announced on May 1, attention again turns to the company’s bold crypto-first financial approach. While traditional financial metrics like earnings and price targets may seem irrelevant—thanks to the ASC 2023-08 accounting adjustment—the real story remains bitcoin’s price and MSTR’s capital market maneuvers.

Led by Michael Saylor, Strategy has turned volatility into a business model, raising $84 billion across equity and fixed-income channels. Its use of stock volatility to issue convertible bonds, generate options trading volume, and offer “yield” strategies has impressed market watchers, even if some criticize the terminology. Its bitcoin-backed preferred shares (STRK, STRF) have gained traction with income-focused investors.

MSTR stock is up 36% this year, outpacing bitcoin’s modest 5% rise. Its $107 billion market cap, underpinned by $53 billion in BTC, has turned it into a movement. New ETFs and financial products, including Grayscale’s 30-company BTC ETF and leveraged MSTR vehicles, reflect the growing appetite for bitcoin exposure in traditional markets.

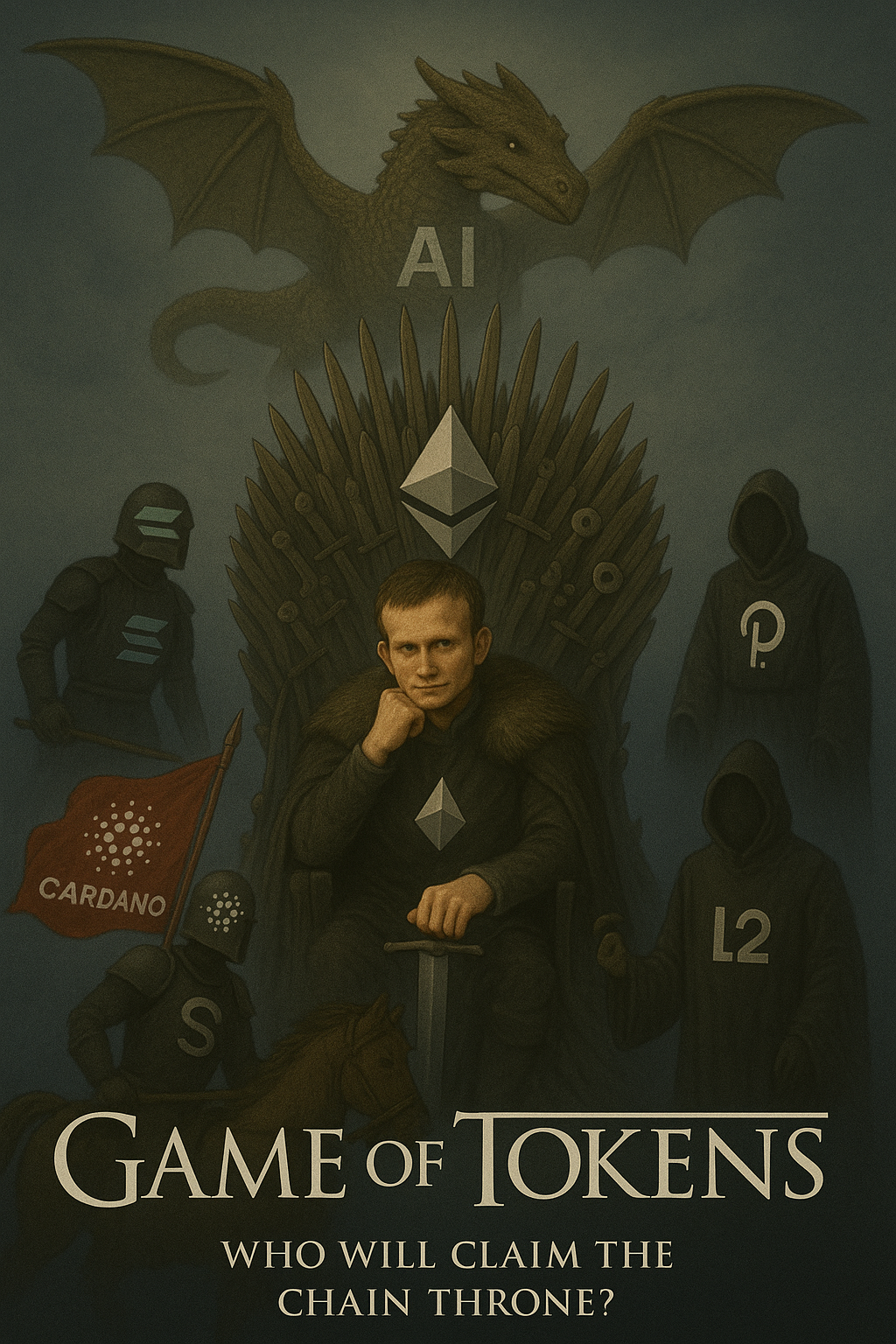

Still, the focus remains narrowly on bitcoin. Despite regulatory easing and more ETF approvals, most U.S. corporate crypto activity centers on BTC. Broader education around Ethereum and other blockchain assets has lagged, limiting diversification in investor portfolios. If 2024 marked bitcoin’s mainstream breakthrough, 2025 must expand the narrative to include the broader digital asset class—lest the U.S. investing scene become a “bitcoin maxi” echo chamber, leaving valuable opportunities unexplored.

As MSTR shapes the future of crypto finance, its approach remains polarizing—but undeniably influential.

Comment 0