As the U.S. and China reignite tensions with tariffs and currency moves, global markets tremble — but one asset seems to benefit from the chaos: Bitcoin.

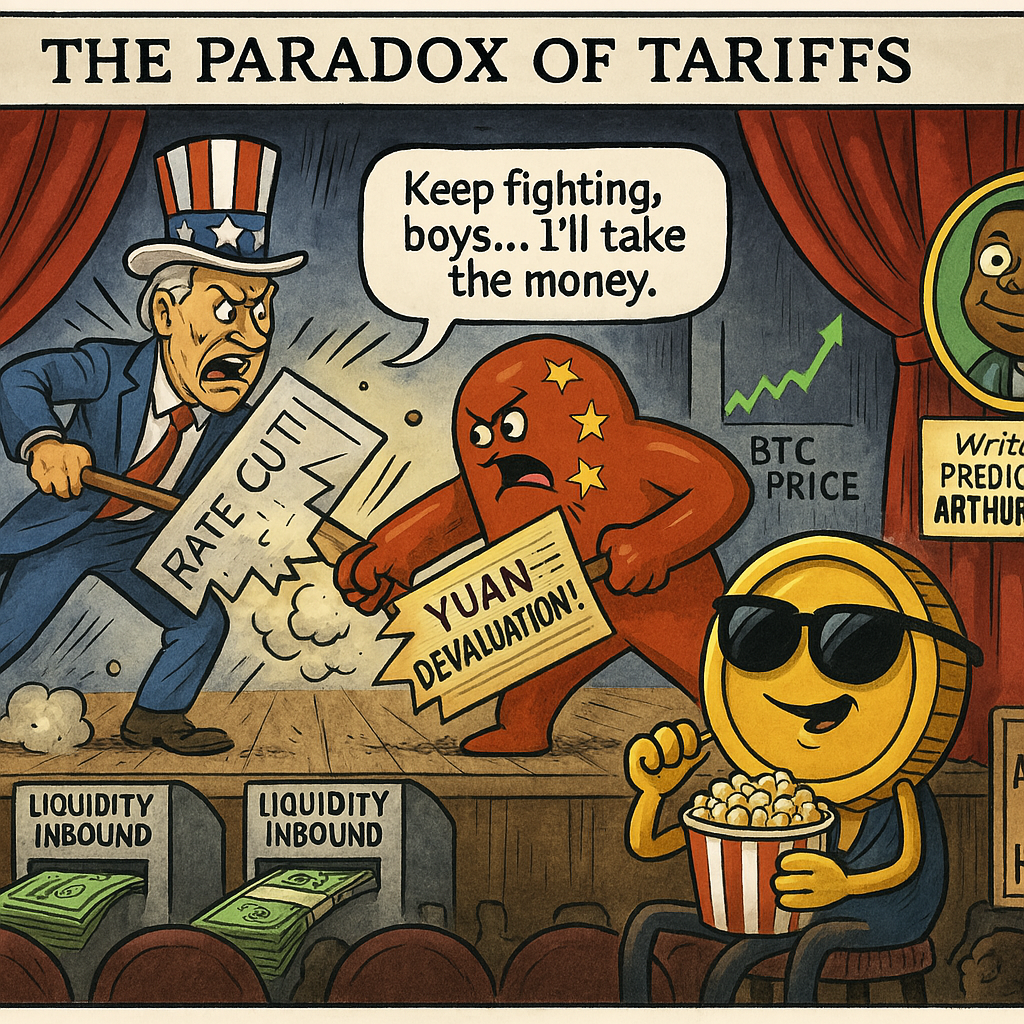

In the cartoon titled “The Paradox of Tariffs,” the United States and China are portrayed as theatrical fighters on a global economic stage. The U.S. swings a weapon labeled “Rate Cut”, while China counters with “Yuan Devaluation.” Their battle symbolizes monetary easing — or quantitative stimulus — as a response to rising economic pressure.

Meanwhile, Bitcoin lounges calmly in the audience, wearing sunglasses and munching on popcorn. A speech bubble says:

“Keep fighting, boys… I’ll take the money.”

Behind the scenes, both countries are secretly printing money — dollar and yuan bills flying out of machines labeled “Liquidity Inbound.” On a giant screen in the background, a green Bitcoin price chart climbs higher, echoing the forecast made by crypto veteran Arthur Hayes, whose name appears on a side banner:

“Written & Predicted by Arthur Hayes.”

The message is clear: While traditional assets suffer from geopolitical tension, Bitcoin could emerge as the winner — not in spite of the chaos, but because of it.

Comment 0