South Korean cryptocurrency exchange, Upbit, has been ranked first among domestic exchanges and tenth globally out of 128 digital asset exchanges around the world, according to a benchmark ranking by UK blockchain analytics firm CryptoCompare. Upbit also recorded the second-highest spot in terms of spot trading volume. The ranking indicates that Upbit has earned the trust of global users as well as domestic ones, as it has been striving to regain users' trust in the wake of coin scams and crimes that have been ongoing since last year.

Upbit received an A grade with a comprehensive score of 70.9 points in the benchmark ranking, making it the number one exchange in South Korea and tenth globally. All 10 Centralized Exchange (CEX) exchanges that received an A grade are included in the top 10. Upbit has risen from a BB grade last year to an A grade this year.

The evaluation criteria for exchanges include security, regulation, market quality, know-your-customer (KYC) and trading risk, data supply, team and exchange, asset quality and diversity, transparency, and demerit factors. CryptoCompare applied over 200 qualitative and quantitative indicators to evaluate exchanges, rating them into eight levels: AA, A, BB, B, C, D, E, and F. Centralized and decentralized exchanges are evaluated using different indicators.

Bitstamp (81.1, AA) took first place globally, while Coinbase (75, A) and Binance (74.4, A) took second and third place respectively. South Korean digital asset exchanges Coinone ranked 26th, Korbit ranked 38th, and Bithumb ranked 40th, all receiving a B grade.

Upbit has become the only domestic exchange to receive an A grade from a reliable global evaluation agency and ranked among the top 10 exchanges globally. Upbit's CEO, Lee Seok-woo, stated that Upbit will continue to make efforts in various aspects such as service quality, security, and investor protection to become a trusted exchange both domestically and internationally.

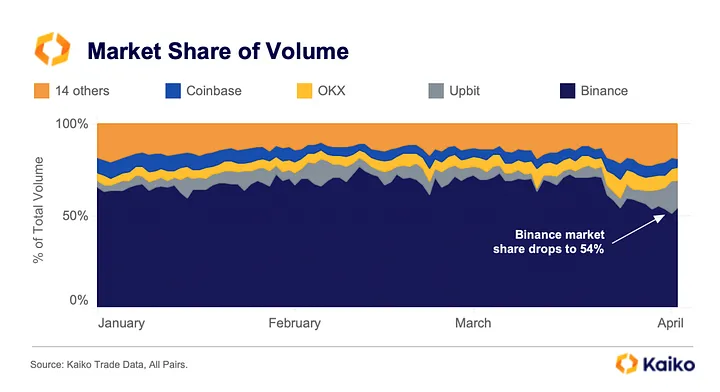

According to blockchain data analysis company Kaiko, Upbit's spot trading volume ranked second globally, which is different from CoinMarketCap's analysis, which is owned by Binance. Kaiko's data excludes self-trading data for centralized exchanges.

While Binance showed a significant drop in its market share, with a 16% decline in the first quarter of this year, Upbit showed a meaningful trading volume among 17 global exchanges. It is speculated that the users' uncertain psychology affected the cryptocurrency market structure due to ongoing bank crises and regulatory crackdowns in the United States.

Recently, most of the trading volume on South Korean exchanges has been concentrated on Ripple (XRP) trading pairs. Upbit has shown significant XRP trading activity that surpassed Bitcoin (BTC) and Ethereum (ETH) in the past.

Additionally, according to blockchain market analysis platform Dooeblock, Upbit ranked second in the "Virtual Currency Exchange without Dollar Support" and "Asia-based Virtual Currency Exchange" categories last month. The total transaction volume of the "Asia-based Virtual Currency Exchange" category was KRW 558.7525 trillion ($49.66 billion), of which approximately 14% or KRW 78.5725 trillion ($6.99 billion) came from Upbit.

Upbit officials stated that they would continue to make efforts to improve trust with users in the virtual asset market and take the lead in creating an environment that is suitable for a virtual asset market ranked in the top 10 globally.

Comment 0