Sweden-based cryptocurrency exchange BTCX is planning to deliver an initial public offering (IPO) before the third quarter of 2020 ends, CEO Oskar Soderstrom confirmed to CoinDesk.

"Our aim is to bring bitcoin to the masses and to bridge the gap between new and traditional finance. Being in new finance, a listing of the company via a traditional route feels like a natural progression to achieve that goal,” Soderstrom wrote in an email.

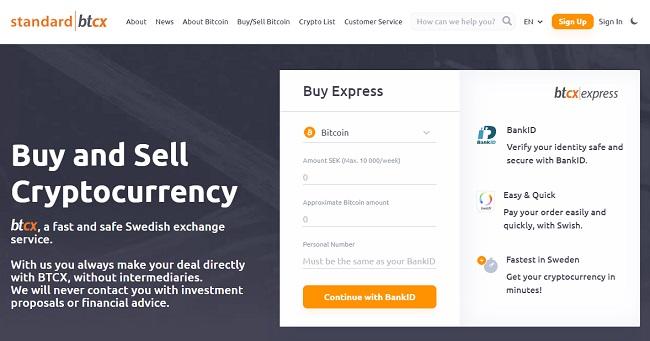

Launched in 2012, BTCX supports bitcoin and ethereum trading and offers fiat funding options in the Swedish Krona and the euro. In addition, it allows its clients to make transfers between digital and fiat currencies quickly with its “express” exchange facility.

Citing the rationale behind considering the traditional route of raising funds, Soderstrom said:

“Choosing a traditional route could add additional transparency to an industry traditionally shaded in the eyes of the public."

However, there are risks in IPOs as well and investors can still lose their money. Chinese bitcoin mining giant Canaan went public in November 2019 and raised $90 million. However, following the IPO, its shares dropped 40 percent.

Despite the risks, Soderstrom is optimistic about his firm's planned IPO if it is managed in the right manner.

"We believe the traditional financial markets will be very interested in Sweden’s older crypto broker being listed,” Soderstrom said.

In November 2019, 3iQ listed its preliminary prospectus for The Bitcoin Fund in preparation for an IPO. It said at the time that the IPO was for the Class A and Class F units, priced at $10 apiece.

Comment 12