Kasikornbank has become the first Thai financial institution to join the Visa B2B Connect pilot program, The Nation reported.

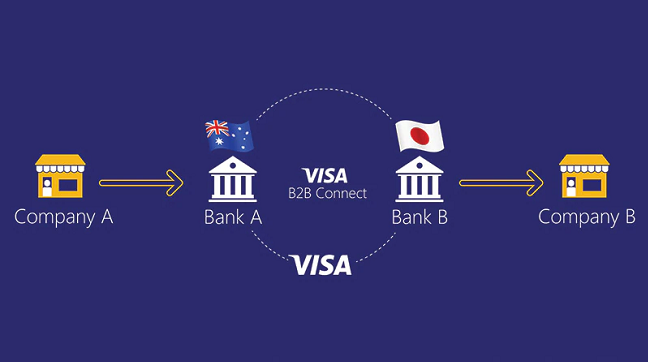

Visa B2B Connect is a platform designed to give financial institutions a secure, fast and predictable way to process corporate cross-border B2B payments. The platform was first previewed in October 2016 and the pilot phase was launched last November.

“Visa is proud that we have representation from a Thai financial institution in the pilot programme. Building on the enterprise blockchain technology, Visa B2B Connect is a new transaction platform designed for the exchange of high-value international payments between participating banks on behalf of their corporate clients. Managed by Visa end-to-end, Visa B2B Connect combines Visa’s core capabilities in security, governance and distributed ledger technology,” Suripong Tantiyanon, Country Manager, Visa Thailand said.

Visa has already collaborated with a number of financial institutions globally to test the platform including Commerce Bank in the U.S., Shinhan Bank in South Korea, Union Bank of Philippines, and United Overseas Bank in Singapore. Kasikornbank is the first Thailand-based bank to join the pilot programme.

Kasikornbank is actively involved in the blockchain space. Earlier this year, it teamed up with other banks to launch electronic letters of guarantee on a shared blockchain platform. In August 2017, Kasikornbank, in collaboration with IBM, launched the blockchain-based letter of guarantee network.

“Through our relationship with Visa, we are excited to be participating in the Visa B2B Connect pilot which is the first step of a new paradigm in reimagining cross-border payment transactions. As the first mover in Thailand, we believe that KBank will be a leader in the industry which benefits KBank’s enterprise clients in terms of more secured payment,” Siriporn Wongtriphop, First Senior Vice President, Kasikornbank said.

To build the platform, Visa worked with Chain and used Chain Core, an enterprise blockchain infrastructure that facilitates financial transactions on scalable, private blockchain networks. The key objective was to enhance the way international B2B payments are currently made by offering improved processing time and visibility into the transaction process, which will help reduce the investment and resources required by banks and their corporate clients to send and receive business payments around the world.

URL copied.

URL copied.

Font size

A

A

A

A

Thai banking giant Kasikornbank to trial Visa’s blockchain-based B2B payments platform

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>

Comment 0