While other crypto investors are panic selling as Bitcoin fell from its previous all-time high above $64,000 to below $43,000 on Monday, MicroStrategy is bucking the trend and buys the dip. The Virginia-based business intelligence firm added another $10 million to its Bitcoin holdings taking advantage of the lower price of the crypto due to the correction.

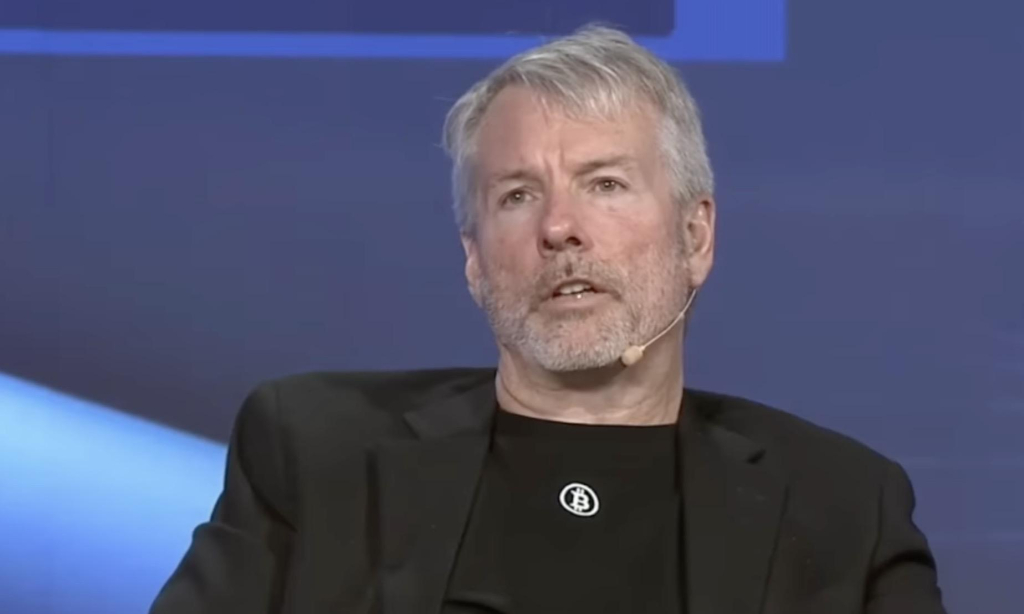

Microstrategy’s recent Bitcoin purchase was announced by CEO Michael Saylor in a Twitter post. The company also disclosed the crypto transaction in an SEC filing on Tuesday.

MicroStrategy revealed that it bought the crypto near its lowest point during the recent correction. “On May 18, 2021, MicroStrategy Incorporated (the “Company”) announced that it had purchased approximately 229 bitcoins for $10.0 million in cash, at an average price of approximately $43,663 per bitcoin, inclusive of fees and expenses,” the company said on its SEC filing.

With the recent acquisition taken into account, MicroStrategy now holds more than 92,000 of BTCs. “As of May 18, 2021, the Company holds approximately 92,079 bitcoins that were acquired at an aggregate purchase price of $2.251 billion and an average purchase price of approximately $24,450 per bitcoin, inclusive of fees and expenses,” the company added.

That means MicroStrategy has almost doubled the value of its crypto holdings even with Bitcoin’s recent price decline. The company’s total holdings were worth around $4 billion as BTC traded above $43,300 at the time of writing based on Coindesk’s price calculator.

MicroStrategy’s recent purchase came just five days after its previous purchase on Tuesday, May 13, 2021. At that time, the company bought 271 BTCs purchase at an average price of 55,387 per Bitcoin, according to Coindesk.

Blockchain analytics firm Glassnode wrote on Monday that Bitcoin’s steep price decline has triggered newer investors to panic sell their BTC holdings even at a loss. Meanwhile, long-term investors of the crypto are viewing the price decline as an opportunity to accumulate just like what MicroStrategy is doing.

“There are strong signals that short-term holders are leading with panic selling, however, long-term holders are stepping in to buy the dip and their confidence is largely unshaken,” Glassnode said. “The PoW energy consumption narrative is nuanced to say the least, and what follows will be a test for the whole Bitcoin market's conviction.”

Comment 6