CoinMarketCap, a provider of price and market cap data for cryptocurrencies, has partnered with Flipside Crypto and has added Fundamental Crypto Asset Score (FCAS) metric to its platform.

Flipside Crypto CEO Dave Balter made the announcement via an online post on Medium.

Headquartered in Boston, Flipside Crypto is market intelligence platform providing fundamental data on all major cryptocurrencies. The company is backed by Coinbase, Founder Collective, Digital Currency Group, True Ventures and others.

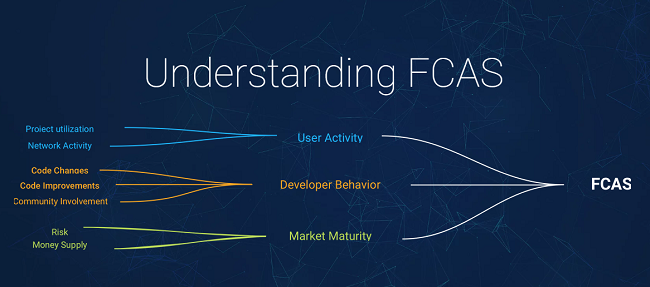

The FCAS metric is a single, consistently comparable value for measuring cryptocurrency project health using thousands of variables across three core algorithms – customer activity, developer behavior, and market risk. The FCAS scoring system rates crypto assets on a 1,000 point scale and with a letter grade.

The FCAS has now been added to CoinMarketCap, alongside other leading publishers including MarketWatch, TheStreet and Stocktwits.

“We’re excited to announce that CoinMarketCap — one the world’s most trusted and accurate source of price and market cap data for crypto currencies — has begun listing FCAS on all of its crypto detail pages,” Walter said. “This follows financial publishers MarketWatch, TheStreet and Stocktwits, which began distributing FCAS in Q1 2019.”

He explained that Flipside Crypto has been tracking FCAS for almost two years and currently provides data on more than 450 projects.

Speaking to CoinDesk, Carylyne Chan, head of global marketing at CoinMarketCap, said that these metrics will bring more transparency as to how these projects are evolving.

“If I’m a new user coming in with more tools and fundamental analysis like FCAS, the focus will be more holistic as opposed to only looking at the front page with the price,” she explained.

Comment 8