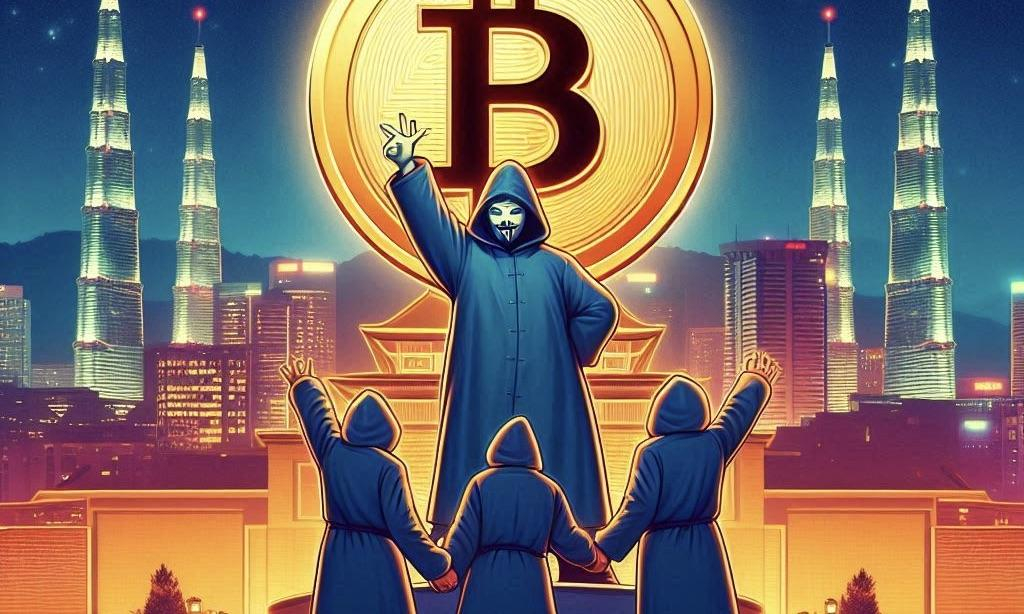

With El Salvador setting the pace by making Bitcoin (BTC) a legal tender in the country, crypto adoption is gaining traction in Latin America. Juan Satori, a senator in Uruguay, just introduced a draft bill that would allow businesses to accept cryptocurrencies payments and regulate their use in the country.

The senator, who belongs to Uruguay’s ruling National Party, posted a tweet about the proposed bill on August 3. “Cryptocurrencies are an opportunity to create investment and work. Today we present a bill, pioneer in the world, that seeks to establish a legitimate, legal and safe use in businesses related to the production and commercialization of virtual currencies in Uruguay,” Juan Satori said.

The bill proposes that “crypto assets will be recognized and accepted by the law and applicable in any legal business,” according to Coindesk. If approved, cryptos will become a valid means of payment and be added to the list of valid forms of payment in the financial inclusion law.

The draft bill seeks to establish cryptocurrencies as “products of free sale by those entities and individuals who wish to commercialize them.” Unlike El Salvador’s case, the bill is not proposing the use of any crypto such as Bitcoin as legal tender.

Once the bill gets approved, the government will issue three types of licenses for businesses using digital currencies. The first type of license allows “companies to trade any crypto-asset such as intermediaries (exchanges) except transactions of non-financial origin,” according to Cointelegraph.

The second type of license is for firms offering custodial services as it enables them to “store, retain or safeguard crypto assets.” Meanwhile, the third type of license is for those planning to issue “crypto-assets or utility tokens with financial characteristics.”

The task of regulating, controlling, and auditing licensed firms will be given to the National Secretariat for the Fight Against Money Laundering and Terrorism Financing (SENACLAFT). The senator said that regulation is necessary for investor protection and to promote investments in the industry.

Comment 4