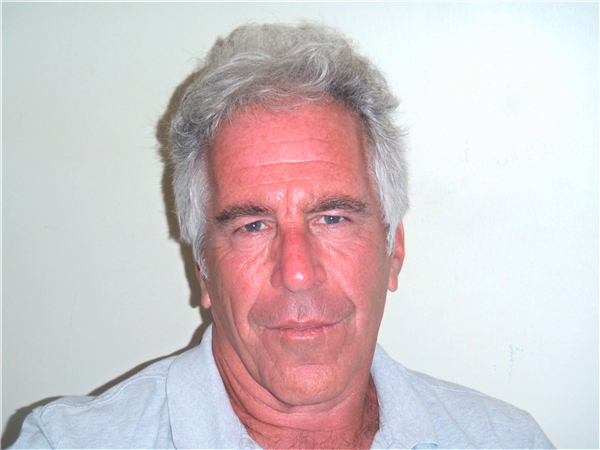

Newly unsealed Justice Department documents have revealed previously undisclosed details about Jeffrey Epstein’s financial ties to Coinbase, showing that the late financier invested $3 million in the crypto exchange during its 2014 Series C funding round and had direct email communication with Coinbase co-founder and board member Fred Ehrsam. The investment occurred years after Epstein’s initial criminal conviction, adding renewed scrutiny to historical relationships in the crypto industry.

According to the documents, Epstein’s stake in Coinbase amounted to less than 1% of the company and carried no governance or decision-making authority. However, the email records show that Ehrsam was aware of the investment discussions and expressed interest in potentially meeting Epstein during the fundraising process. In one email, Ehrsam noted he had availability in New York and said it “would be nice to meet him if convenient,” though he indicated the meeting was not critical.

The emails also reveal that Epstein was initially introduced to the Coinbase opportunity through crypto entrepreneur Brock Pierce, whose venture capital firm, Blockchain Capital, was involved in the Series C round. Pierce described Coinbase at the time as a highly attractive investment, calling it “the most platinum-plated deal in the space.” Epstein even sought outside advice, contacting LinkedIn co-founder Reid Hoffman, who discouraged him from participating. Despite that warning, Epstein proceeded with the investment independently.

Records show that Epstein invested through IGO Company LLC, a U.S. Virgin Islands-based entity managed by his longtime associate Darren Indyke. A valuation report from December 2014 confirms a $3,001,000 purchase of Coinbase shares through this entity. While Blockchain Capital later stated that its own fund investment tied to Epstein was never completed, documents indicate the firm attempted to buy out Epstein’s Coinbase stake in 2018, valuing the company at up to $4 billion.

By February 2018, Epstein had sold half of his Coinbase position for approximately $15 million, generating a substantial profit. Coinbase declined to comment on the revelations, which have resurfaced amid heightened legal and reputational concerns surrounding individuals and institutions linked to Epstein following major bank settlements with his victims.

Comment 0