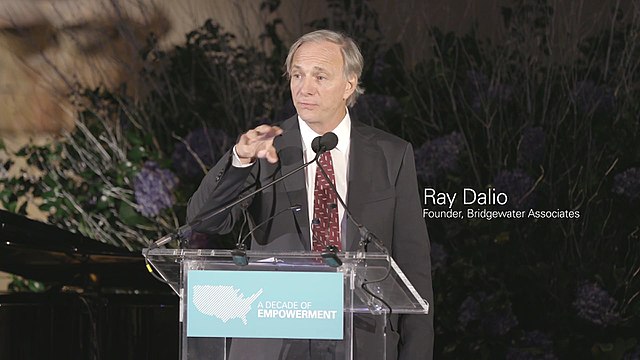

Ray Dalio, the founder of the world’s largest hedge fund Bridgewater Associates, recently talked about the looming debt crisis. With the U.S. dollar likely to be devalued due to the government’s money printing activities, the billionaire investor believes that Bitcoin (BTC) would become increasingly attractive as an investment vehicle.

In fact, Dalio already admitted that he owns some of the crypto. “I have some Bitcoin,” he told CoinDesk Chief Content Officer Michael J. Casey during the 2021 Consensus conference. “I think that Bitcoin’s greatest risk is its success.”

He also expressed concern about the risk of government regulation, which could come as the Bitcoin market becomes bigger. “As it becomes a bigger deal and more of a threat - let’s say people want to sell their bonds and they want to buy Bitcoin and they want to do that in a bigger way - they lose control over that… that’s an existential risk,” Dalio said.

Governments could rush in as bondholders sell the instruments in favor of the crypto. “The more we create savings in [bitcoin], the more you might say, ‘I’d rather have bitcoin than the bond.’ Personally, I’d rather have bitcoin than a bond. And then the more that happens, then it goes into bitcoin and it doesn’t go into credit, then [governments] lose control of that,” Dalio explained.

The billionaire investor said that he is increasingly worried that the government might try to exert more control over the digital assets industry. Lately, the recent crypto market correction has spurred various government agencies reevaluating regulations raising concerns on possible stricter regulatory policies. The Treasury Department recently released a new rule requiring that crypto transfers worth $10,000 or higher must be reported to the IRS.

“One of the great things, I think, as a worry is the government having the capacity to control almost any of them, including bitcoin, or the digital currencies,” Dalio opined. “They know where they are, and they know what’s going on.”

Comment 0