Jeremy Allaire, CEO of stablecoin issuer Circle, has called for the immediate repeal of regulations that hinder the cryptocurrency industry. Speaking at the Reuters Global Markets Forum during the World Economic Forum, Allaire specifically criticized the SEC's Staff Accounting Bulletin (SAB) 121, urging the Trump administration to eliminate policies that obstruct the integration of digital assets and traditional finance.

SAB 121 mandates that publicly traded companies classify cryptocurrencies held on behalf of others as liabilities. Critics argue that this guideline prevents banks from holding cryptocurrencies due to strict capital reserve requirements. While Congress passed legislation to repeal SAB 121 last year, it was vetoed by President Biden, leaving the regulation in place.

Allaire described SAB 121 as a punitive measure against banks and financial institutions attempting to include cryptocurrencies on their balance sheets. He emphasized that repealing such regulations could significantly accelerate the adoption of digital assets within the broader financial ecosystem.

Circle, the issuer of the second-largest stablecoin, USD Coin (USDC), expressed optimism about the Trump administration’s potential to adopt crypto-friendly policies. Ahead of the presidential inauguration, Circle donated 1 million USDC to signal its support for the administration.

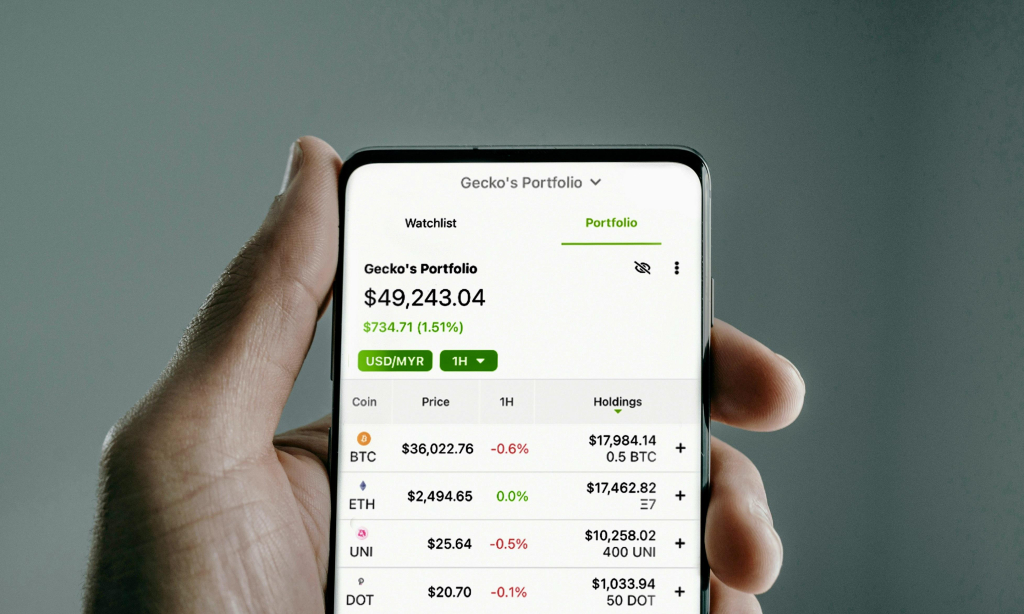

Despite industry anticipation, President Trump did not announce any immediate actions related to cryptocurrency on his first day in office. His inaugural address and executive orders focused on tariffs, immigration, and energy independence. Bitcoin, which had hit an all-time high of $109,000 before the inauguration, retreated to just above $100,000.

Richard Galvin, co-founder of hedge fund DACM, told Bloomberg that while no immediate action on cryptocurrency was taken, “it’s premature to draw conclusions, given the administration’s broad priorities.” TD Cowen analyst Jaret Seiberg noted that the lack of a crypto-related executive order was unexpected but speculated that one could still emerge in the near term, albeit without significant impact.

The cryptocurrency industry remains hopeful that the new administration will create a regulatory environment conducive to digital asset growth, balancing innovation with necessary oversight.

Comment 0