MicroStrategy Inc. is known as one of the top publicly listed firms with Bitcoin (BTC) as part of their reserve assets. But its already sizable hoard still isn’t enough as the company recently announced plans to buy more of the crypto.

MicroStrategy announced on Monday, December 7, that it plans to raise up to $400 million via the issuance of senior convertible notes, Coindesk reported. The report added that proceeds will likely be used for the business intelligence firm’s acquisition of additional Bitcoin.

The notes will carry a five-year term and will only be offered to institutional investors. “MicroStrategy® Incorporated (Nasdaq: MSTR) today announced that it intends to offer, subject to market conditions and other factors, $400 million aggregate principal amount of convertible senior notes due 2025 (the ‘notes’) in a private offering to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the ‘Securities Act’),” the company said in a press release.

Buyers of the debt instruments will receive semi-annual interest payments. However, the company did not yet reveal the interest rate for the notes.

“The notes will be unsecured, senior obligations of MicroStrategy and will bear interest payable semi-annually in arrears on June 15 and December 15 of each year, beginning on June 15, 2021,” MicroStrategy explained. “The notes will mature on December 15, 2025, unless earlier repurchased, redeemed or converted in accordance with their terms.”

The company added that it plans to purchase additional Bitcoin (BTC) from the proceeds after allocating for necessary expenses. “MicroStrategy intends to invest the net proceeds from the sale of the notes in bitcoin in accordance with its Treasury Reserve Policy pending the identification of working capital needs and other general corporate purposes,” the business intelligence firm said.

MicroStrategy may give holders of the notes the option to convert them into cash or class A shares or a combination of both starting December 2023. However, this will only happen after certain conditions are met.

“Subject to certain conditions, on or after December 20, 2023, MicroStrategy may redeem for cash all or a portion of the notes,” the company explained. “The notes will be convertible into cash, shares of MicroStrategy’s class A common stock, or a combination of cash and shares of MicroStrategy’s class A common stock, at MicroStrategy’s election.”

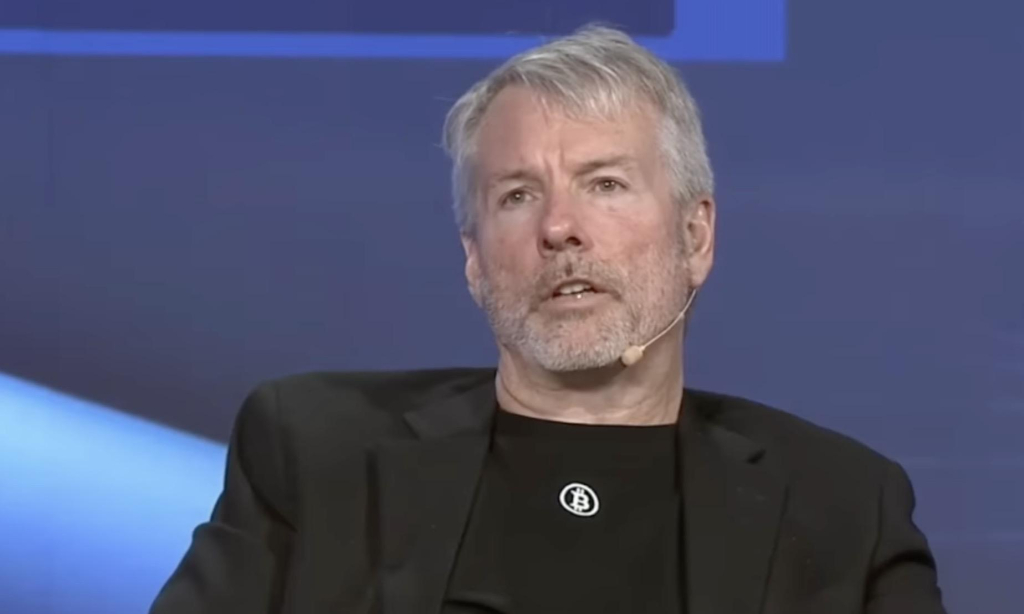

The company’s announcement to acquire more Bitcoin came right after it revealed the number of Bitcoins it holds. MicroStrategy Michael Saylor confirmed last week that the firm already has 40,824 BTC in its treasury reserve.

Comment 17