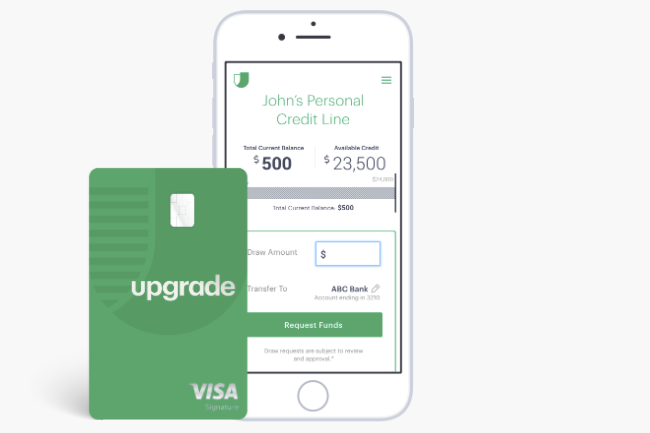

Neobank Upgrade, Inc. has launched its first contactless-enabled Upgrade Card.

In a press release, Upgrade also announced that the card will be available in digital form through Apple Pay and Google Pay to enable mobile payments. The launch is just in time as the World Health Organization (WHO) has recommended contactless payments and to limit the use of banknotes to curb the transmission of coronavirus.

Upgrade is a neobank that offers affordable and responsible credit to mainstream through personal loans and cards along with credit monitoring and educational tools to help consumers better understand and manage their finances. The firm has already released over $2.5 billion in loans and cards since 2017. It is headquartered in San Francisco, California.

“These new Upgrade Card features enable payments without any surface contact,” said Renaud Laplanche, Upgrade co-founder and CEO. “While more customers have been shopping online since the start of the COVID-19 pandemic, many are still using their card in stores. We want to do what we can to keep our customers safe and give them a smarter way to pay.”

Upgrade Card has been launched in October 2019 and there is a rapid adoption in the U.S. with annual rate of $500 million in new credit lines. It works differently than other cards because it combines monthly charges into installment plans that are payable for 24 to 60 months. As a result, the consumers have to pay less and avoid the revolving debt trap of traditional credit cards.

Upgrade Card is the smarter way to pay and it has no fees and with credit lines from $500 to $20,000. It has a lower cost than traditional credit cards too and can be used wherever Visa is accepted.

Comment 25