If you understand charts, bitcoin or stock trading can be profitable.

If you jump in with no knowledge of trading patterns, trading in any form will lose you money.

Trading Bitcoin

Bitcoin price volatility is important for traders because it creates profit opportunities, provided you understand the meaning of the charts.

Buying Bitcoin at random, without knowledge is a great way to lose your money. You need to spend a lot of time on research; finding the best place to buy Bitcoin, finding a hack-resistant wallet provider, and finding good advice. The last is the most important.

Advice comes easily to journalists and bloggers. It’s not their money after all.

How do you acquire the knowledge to understand candlestick and other charts? You get it from websites specializing in giving independent financial advice, or via forex brokers who lets you trade via a Bitcoin CFD against the US dollar.

If you want to own and trade actual Bitcoin, you need a bitcoin wallet: Coinbase is a well-known and reputable wallet provider and their interface is simple to use.

The headline Bitcoin price may range from $7,000 to $9,000 per coin. However, you can buy tiny fractions of a Bitcoin, so you can start trading with $20 worth while you are learning to read the ups and downs of the market. This applies whether you’re buying Bitcoin on a crypto exchange, or trading the Bitcoin price with a forex broker. Whatever route you take, trading with your own money will teach you more than using a demo account that lets you use pretend money.

You need to be able to read the market because you must buy AND sell Bitcoin to increase your wealth, and the timing of your trades is crucial. If you buy when everyone else is buying, you will pay more, and if you sell when there is bad news and everyone wants to sell, your Bitcoins will be worth less in fiat currency.

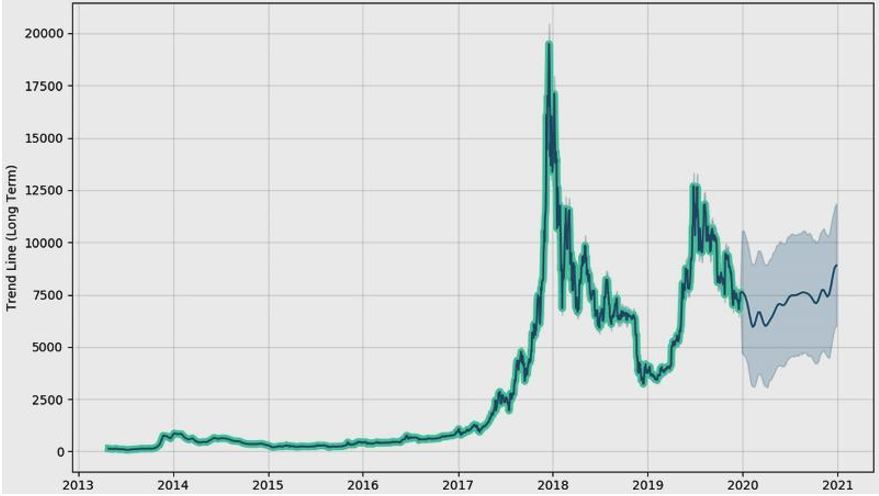

The chart below courtesy of WalletInvestor.com shows just how volatile Bitcoin values have been over the past six years. (Take the predicted values with a pound of salt, predictions come cheap.)

Trading Stocks

Changes in stock market share prices over a few days, weeks, or months are usually only slight. This means that the potential for large profits (or losses) is much lower than if you trade Bitcoin.

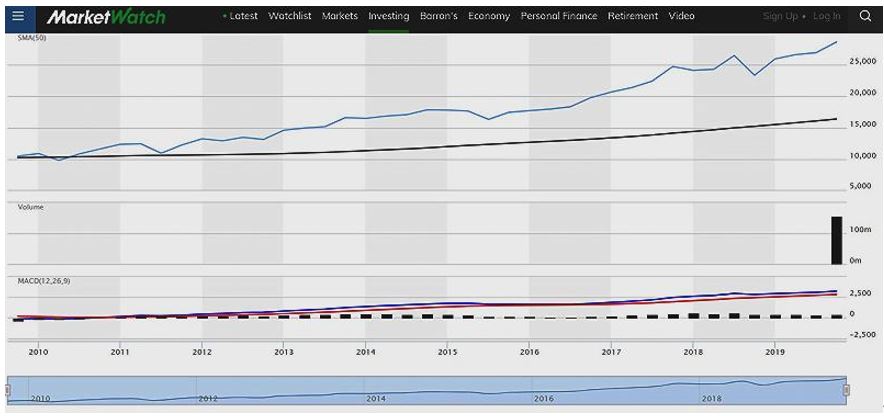

These two charts (Bitcoin value above, and the Dow Jones moving average chart below) illustrate the huge volatility difference in the two markets.

Stocks do trend upwards as the 10-Year Dow Jones chart from Marketwatch below shows:

Yes, the daily chart will show more variation, but stocks are basically a long-term investment vehicle for most people. You will find tips in newspapers and online, but thousands of other people will also be basing their ‘strategy’ on those same tips, so you are unlikely to get the best prices whether you are buying or selling.

Trading Vs. Investing

Trading means you buy when you anticipate short-term price growth: buying low and selling high. There is a risk that the price could fall after your purchase, but your loss is limited to the amount you paid.

You can also sell before you buy if you prices to fall by using CFDs. You short a stock you don’t own by selling it at a high price, then buying it at (hopefully) a lower price. It is especially risky because the price could go up after you buy, so the potential loss on each trade is unlimited.

Most people hold stocks for the long-term, years or even decades. They choose stocks that pay good dividends, have good capital growth prospects, or both. Holding stocks for years makes you an investor rather than a trader.

Your pension fund and life assurance policy fund are mostly invested in blue-chip shares in the stock market. These funds mostly choose low-risk investments, though some funds do specialize in higher-risk growth shares or in particular market sectors such as technology or property.

The Short Version

Bitcoin’s price volatility is famous, and it is what makes trading in the cryptocurrency so attractive for traders who welcome an element of risk in exchange for large rewards.

However, Bitcoin trading is not for the faint of heart or uneducated. You must understand candlestick charts and how they help predict future price rises and falls. Forex sites are a good place to start if you are a beginner and need to learn about predicting future prices from charts.

Every hour you spend learning how to read charts will repay a thousand times over because you will avoid expensive mistakes in timing your trades. Buying high and selling low are the most common mistakes new traders make, which is why so many start trading, lose money and then give up.

This article does not necessarily reflect the opinions of the editors or management of Tokenpost.

Comment 50