Bitcoin ATM operator Coinsource has partnered with the Maker Foundation to launch support for the Dai stablecoin on its machines this summer ahead of the rollout of a full remittance service, CoinDesk reported.

Coinsource has over 230 machines in 29 states across the United States and the District of Columbia. It will now update these machines to allow customers to buy, sell, and store Dai stablecoins.

The subsequent phase of the rollout will see the launch of a remittance service that will allow crypto ATM and Dai users to send cash from wallet to wallet. Upon fulfilling the necessary KYC requirements, users would be able to deposit funds into a wallet and send that to recipient parties, Reuters said.

Recipients would then be able to instantly redeem their transaction at any Coinsource machine or supported location. Currently, the remittance service is available only in the United States.

#Dai is coming to all @Coin_Source #BitcoinATMs! https://t.co/OKhuTnVsix

— Maker (@MakerDAO) June 26, 2019

The announcement comes as Coinsource plans to extend financial services to the underserved and unbanked population.

“By offering support for Dai, we can provide the benefits of crypto to customers who are without access to bank accounts, while at the same time allowing them to avoid the price volatility typically associated with today’s often fluctuating crypto markets,” said Sheffield Clark, CEO of Coinsource, said.

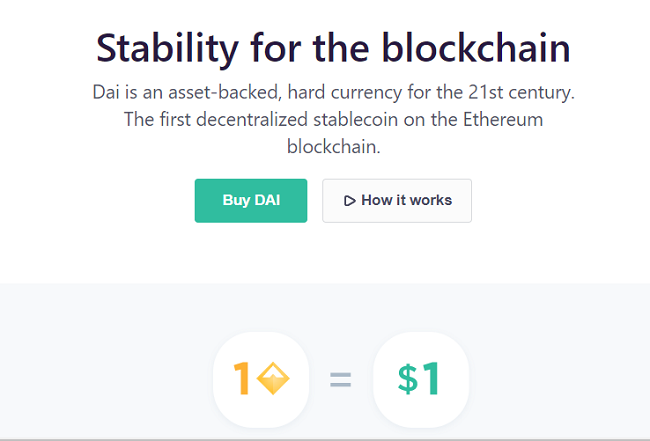

According to the Dai whitepaper, the Dai stablecoin is a collateral-backed cryptocurrency whose value is stable relative to the US Dollar. Every Dai is backed by another asset of value – the collateral portfolio is diversified, allowing multiple assets to guarantee the value of each Dai, the website states.

Maker is a smart contract platform on Ethereum that backs and stabilizes the value of Dai through a dynamic system of Collateralized Debt Positions (CDPs), autonomous feedback mechanisms, and appropriately incentivized external actors.

CoinDesk explained that MakerDAO allows users to keep ethereum as collateral via a smart contract in exchange for Dai. Approximately 2 percent (around $340 million) of all ethereum is locked in DAO’s decentralized finance application.

Comment 50