Global investment app Abra has announced the launch of a new feature that will allow users outside of the United States to make fractional investments in stocks and exchange-traded funds (ETFs) using bitcoin.

Touting the feature as an industry first, Abra said that it marks the next step in its vision to Bitcoin’s programmable money features to create and democratize new financial products and services for users across the globe. The feature will enable users in over 150 countries to invest in fractional shares of traditional stocks and ETFs using the digital currency.

Bill Barhydt, CEO and founder of Abra, said that the focus of this launch to make financial markets of the developed world more accessible and affordable to those in emerging economies.

“[O]utside of the United States, most of the world’s population is not invested in financial assets or markets due to issues of access and affordability,” said Barhydt. “Abra is addressing this global inequality by allowing more people to have a stake in financial markets.”

Similar to owning a fraction of a bitcoin, investors would now be able to use Abra to own fractions of high-priced stocks and ETFs with a minimum of $5 per investment. This includes:

- Popular stocks like Tesla, Uber, Apple, Amazon, Google, Netflix, and Berkshire Hathaway.

- Commodities such as SPDR Gold Trust and oil.

- Indexes including Vanguard Growth, the S&P 500, Real Estate, and the Russell 2000.

- International markets including Asia, Australia, Mexico, and Emerging Markets index funds.

Willie Wang, VP of product at Abra, said that tens of thousands of investors from across the globe have already signed up for the waitlist to access this new product.

“We’re excited to see which assets are most in demand globally and will continue to add assets as we collect feedback from users,” he added.

As a promotional offer, Abra announced that it would not charge trading fees for the rest of 2019 on stock and ETF investments.

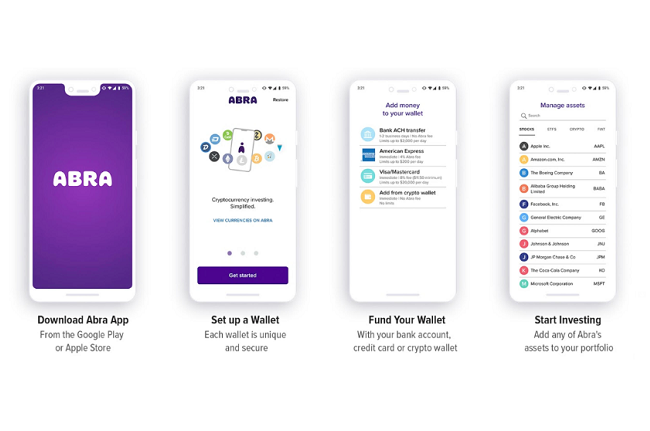

San Francisco-based Abra is a non-custodial platform, meaning that funds are stored on the Bitcoin blockchain, which makes the transactions more secure and private than centralized databases used by most crypto exchanges and wallets. It is backed by several prominent investors including American Express Ventures, Foxconn Technology Group, Arbor Ventures, Lerer Hippeau, RRE Ventures, Silver 8 Capital and others.

Comment 13