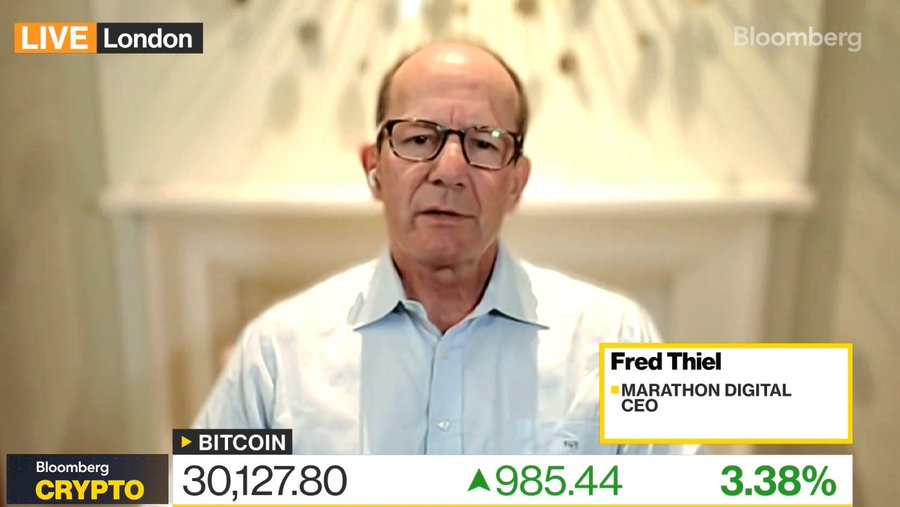

Fred Thiel, CEO of Marathon Digital, has commented on the recent downturn in the cryptocurrency market, describing it as a period of stress that is beneficial in purging the industry of "unsavory operators."

Thiel, whose company operates Bitcoin mining rigs, spoke at the Financial Times's Crypto and Digital Assets Summit, drawing parallels between last year's market upheaval and the dot-com boom.

He praised the regulatory efforts of the EU, UK, Hong Kong, Singapore, and the UAE, highlighting the U.S. as lagging behind in this regard.

Thiel believes that higher interest rates will lead to greater risk aversion among investors and contribute to a more mature and commercialized crypto industry.

The high-profile collapses of crypto entities last year have had ripple effects throughout the sector, with an increasing number of firms facing insolvency.

The recent filing for Chapter 11 bankruptcy protection by Bittrex, a prominent exchange, is the latest example. Speaking at the same conference, Kristin Smith, CEO of the Blockchain Association, remarked that it was "probably a good time to be a bankruptcy attorney."

Smith also pointed out potential positive side effects resulting from the downfall of crypto firms, highlighting the importance of cleaning up mismanagement and creating opportunities for other players to acquire assets from collapsed entities.

Thiel and Smith's statements suggest that the recent downturn in the cryptocurrency market may ultimately yield positive outcomes, such as enhanced regulation and the removal of bad actors from the industry.

However, the ongoing collapse of crypto firms serves as a reminder for investors to exercise caution, particularly as interest rates rise and risk becomes less enticing.

Comment 0