Upcoming cryptocurrency derivatives exchange Blade has secured $4.3 million in seed funding from major investors including cryptocurrency platform Coinbase and investment firm SV Angel, according to a report by Tech Crunch.

Slow Ventures, A.Capital, Justin Kan, and Adam D’Angelo also participated in the funding round.

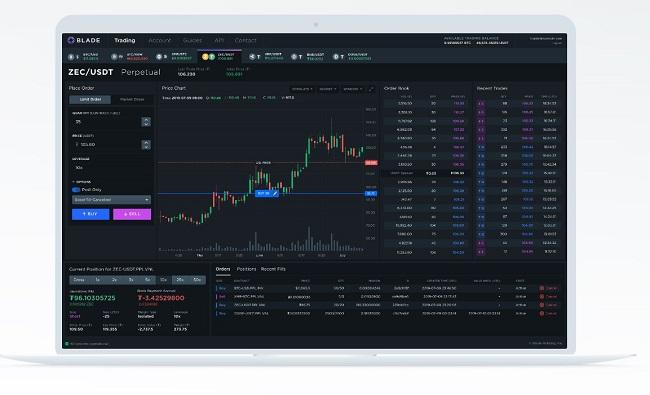

As per the report, Blade, which is set to launch in three weeks, aims to provide trading for cryptocurrency-based perpetual swap contracts with some notable enhancements.

For instance, perpetual contracts will be drawn up using standard, simple contracts. They will use Tether’s stablecoin USDT for settlement and margins. And lastly, they offer higher leverages of up to 150 times their price for cryptocurrency trading pairs.

The report noted that crypto perpetuals enable traders to bet on a cryptocurrency price with respect to another currency. But unlike fixed maturity futures, perpetuals have no expiration dates. Currently, there are seven different trading pairs for perpetuals listed on Blade.

“In the long term, we want to be the CME of crypto… Coinbase and Binance are building this foundation structure for crypto, but I think we are too and in a sense that derivatives are at their core about risk transfer, we want to be building the foundational layer for risk transfer in the crypto markets,” Blade CEO Jeff Byun told the news outlet.

As previously reported, cryptocurrency trading desk and market maker Altonomy has raised $7 million in a seed round led by Polychain Capital, a San Francisco-based crypto-focused investment firm, which will be used to source liquidity for institutional clients including spot and derivatives exchanges.

Comment 11