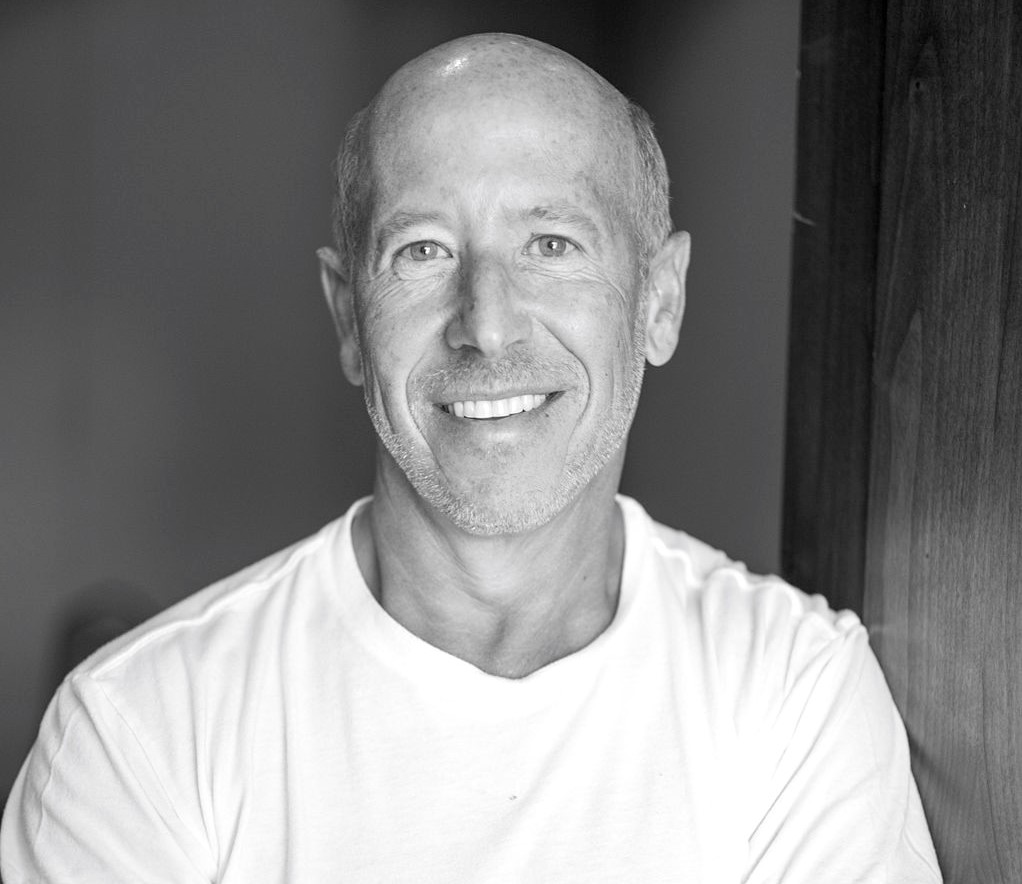

Crypto billionaire Sam Bankman-Fried just signed a deal with BlockFi Inc., that helped solve the lender’s financial issues. The FTX co-founder and CEO also revealed that he is open to potential acquisitions among troubled Bitcoin (BTC) mining firms to help stabilize the industry.

The announcement came just as Bitcoin miners are facing distress due to low crypto prices squeezing out profits that many resorted to unloading their crypto holdings to meet liquidity requirements. Sam Bankman-Fried said that he is considering buying out troubled miners to help stem credit contagion in the industry.

“When we think about the mining industry, they do play a little bit of role in the possible contagion spread, to the extent that there are miners that were collateralizing borrows with their mining rigs,” Bankman-Fried told Bloomberg in an interview on July 1. “There might come along a really compelling opportunity for us -- I definitely don’t want to discount that possibility.”

Both publicly-listed and private crypto mining firms are facing margin calls and details after accumulating massive debts to construct large-scale mining facilities across North America, Based on data compiled by Coindesk, miners have racked up anywhere between $2 billion to $4 billion to fund their recent expansion programs.

It is difficult for crypto miners to raise capital and pay their debts with the current market downturn. Shares of publicly-traded mining firms are down by as much as 75 percent year to date.

“To be clear I said roughly ‘meh not particularly looking at miners, but sure, happy to have conversations with any companies’,” the crypto billionaire tweeted on Saturday.

Bankman-Fried has acted as a lender of last resort and helped some troubled crypto during the recent meltdown. Through his trading firm, Alameda Research, he extended a cash/USDC loan of $200 million as well as a revolving credit facility for 15,000 Bitcoin (around $294 million) to crypto exchange Voyager Digital.

He also recently signed a deal with the crypto lender BlockFi that extended a $400 million credit facility to the firm. Included in the deal is the potential to acquire BlockFi for as much as $240 million.

Comment 69