Rostin Behnam, the chair of the Commodity Futures Trading Commission (CFTC), emphasized the pressing need for legislation to provide regulatory clarity in the crypto industry and ensure adequate protection for investors.

He made this assertion during his March 6 testimony before the House Agriculture Committee, which primarily focused on the CFTC's fiscal year 2025 budget request.

Challenges and Opportunities in the Crypto Market

Addressing the committee, Behnam highlighted the challenges and opportunities presented by digital assets such as Bitcoin (BTC) and Ethereum (ETH), which constitute a significant portion of the crypto market's total capitalization. Despite prevailing misconceptions among regulators and lawmakers that the relevance of the digital assets market might diminish, Behnam argued that demand for these assets has surged exponentially over the past decade.

He emphasized the necessity of proactive legislative measures to establish a stable and transparent regulatory environment. Given the escalating interest in digital assets since the beginning of the year, protecting investors should be the government's foremost priority, according to Behnam.

Behnam projected that the CFTC's development of a comprehensive regulatory framework for digital assets would take approximately 12 months, contingent upon Congress passing the Financial Innovation and Technology Act for the 21st Century (FIT Act).

According to Crypto Slate, this proposed legislation, aimed at clarifying regulatory responsibilities concerning digital assets, has made progress through the House Agriculture and Financial Services Committees but has yet to reach a floor vote.

A Coingape report states as the CFTC faces the challenge of allocating a substantial portion of its resources to crypto enforcement, the necessity for a regulatory framework capable of adapting to the ever-changing landscape of digital assets becomes more evident.

Classification of BTC and ETH as Commodities

During the hearing, Behnam also addressed inquiries from committee members regarding the classification of digital currencies as commodities or securities, a distinction crucial for regulatory jurisdiction.

Responding to a query from Rep. John Duarte, Behnam clarified that digital assets are generally deemed commodities if they fail to meet the criteria for classification as securities, underscoring the nuanced approach required for effective regulation of these assets.

Behnam affirmed that Bitcoin and Ethereum do not satisfy the criteria for classification as securities, automatically placing them under the commodities umbrella, despite their vast differences from physical commodities like gold or corn.

He acknowledged the substantial appetite for Bitcoin among retail and institutional investors, irrespective of the government's stance on legitimizing it. Behnam conceded that regulators have attempted to fit crypto into existing frameworks, advocating for the industry to be considered separately to address its unique characteristics.

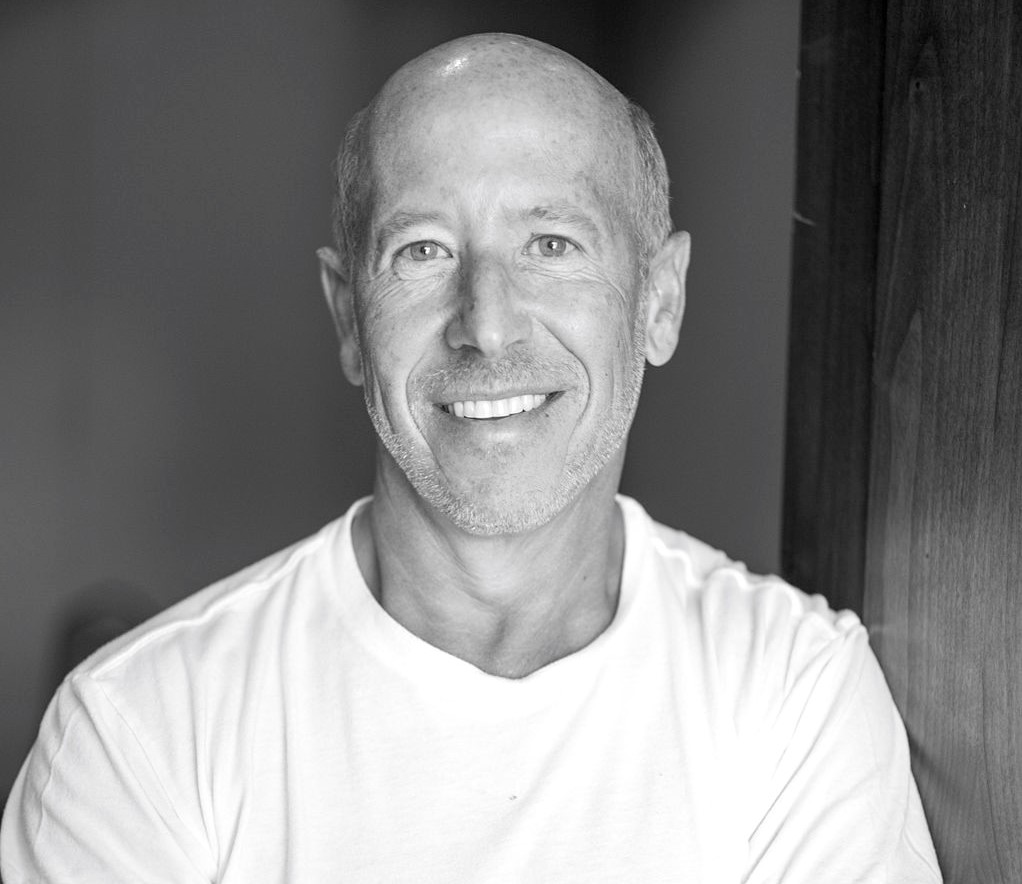

Photo: Darren Halstead/Unsplash

Comment 0