Senior leaders of the U.S. Senate Judiciary Committee have raised strong objections to the inclusion of the Blockchain Regulatory Certainty Act (BCRA) in broader crypto market structure legislation, arguing that it could weaken federal money transmitter enforcement and limit the government’s ability to prosecute illicit activity tied to digital assets.

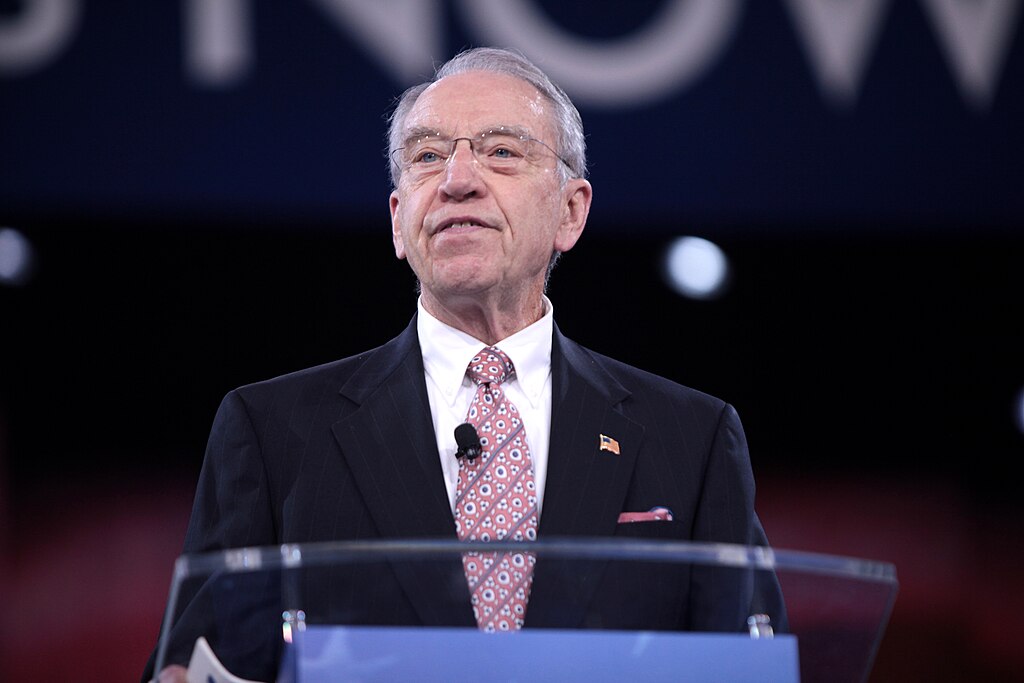

In a letter dated January 14 and sent to the Senate Banking Committee, Judiciary Committee Chairman Chuck Grassley and Ranking Member Dick Durbin warned that Section 604 of the proposed market structure bill would undermine existing federal laws governing unlicensed money transmitting businesses. The provision is intended to shield software developers from criminal liability when third parties misuse their products, a key demand from decentralized finance and crypto developer advocates.

However, the senators cautioned that such protections could go too far. They emphasized that the Judiciary Committee, which has jurisdiction over Title 18 of the U.S. Code, was not consulted during the drafting process. According to the letter, the lack of review raises serious concerns about unintended legal consequences for federal enforcement efforts.

Grassley and Durbin pointed to the Department of Justice’s ongoing case against Roman Storm, a developer associated with Tornado Cash, as evidence of why existing statutes remain necessary. They argued that the prosecution demonstrates the importance of maintaining strong laws to hold individuals accountable when they are connected to unlicensed money transmitting operations, even in the context of open-source or decentralized technologies.

The letter represents another setback for the Senate Banking Committee’s crypto market structure bill, which was scheduled for debate and a vote before being postponed amid growing opposition. Sources familiar with the negotiations told CoinDesk that the Blockchain Regulatory Certainty Act has been one of the most divisive elements of the legislation, with several Democrats resisting its inclusion in the latest draft.

Earlier this week, Senators Cynthia Lummis and Ron Wyden introduced the BCRA as a standalone bill, signaling that it might be removed from the larger package. If it remains, the Judiciary Committee could become a third panel required to approve the legislation, further complicating its path forward.

Despite the criticism, DeFi advocates continue to argue that excluding these protections could cost the bill crucial industry support, setting the stage for a continued impasse over crypto regulation in Congress.

Comment 0