Recent Price Volatility Driven by Whale Trading

XRP has experienced significant price swings recently, primarily due to large investors, known as whales. Over the weekend, these whales purchased approximately 160 million XRP, valued at around $380 million, which contributed to a recent price surge. However, after reaching a high of $2.80, some traders began to take profits, leading to long liquidations totaling over $20 million as positions were closed amid market volatility. This selling pressure has created a mixed market environment for XRP, as whales continue to buy while many other investors sell.

Positive Outlook for XRP ETF Approval

Bitwise analysts suggest that an XRP exchange-traded fund (ETF) could gain approval from the SEC in 2025, driven by increasing interest from retail investors and potential regulatory changes. Several firms, including Bitwise and WisdomTree, have applied for XRP ETFs amidst ongoing legal challenges facing Ripple. The upcoming U.S. presidential election may also affect how the SEC handles cryptocurrency regulation. Overall, positive market sentiment and heightened demand make the outlook for an XRP ETF promising.

WisdomTree Enters the ETF Space

WisdomTree has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch a spot XRP exchange-traded fund (ETF). This filing, submitted on December 2, 2024, positions WisdomTree as the fourth firm to seek approval for such a product, joining Bitwise, 21Shares, and Canary Capital in this endeavor.

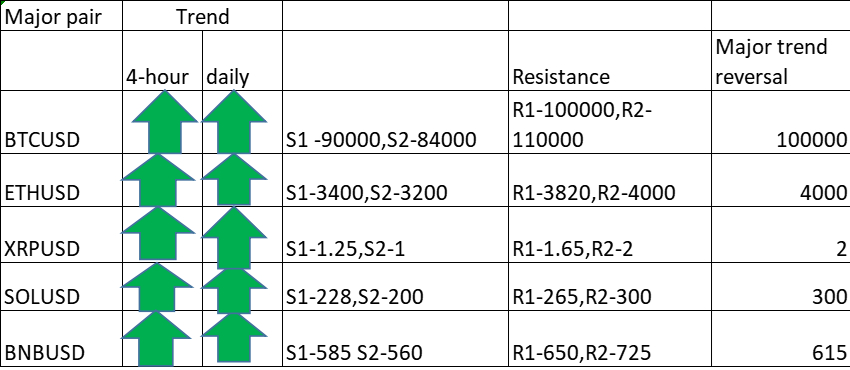

Technical Analysis: Retracement and Support Levels

XRPUSD has retraced slightly after a remarkable jump of nearly 100% last week. It reached a high of $2.50 and is currently trading around $2.23. A daily close below $1.60 would indicate a further minor bearish trend. However, the pair is still trading above both short-term (34 EMA and 55 EMA) and long-term moving averages (200-day EMA) on the 4-hour chart, indicating some stability.

Resistance and Support Insights

The immediate resistance level for XRP is around $3; a breakout above this level could push the price towards $3. If it surpasses $3.30, a major bullish trend may emerge, potentially leading to targets of $4 or $5. On the downside, immediate support is at $2.50, with further targets at $2.20, $2.00, $1.60, $1.27, $1.00, $0.85, and $0.74.

Overbought Indicators Suggest Caution

Current market indicators show the Daily RSI at 94.89 and the Weekly RSI at 90.58, indicating an overbought condition and suggesting a minor sell-off toward $2 may be possible. Market indicators such as the Directional Movement Index and CCI (50) are bullish, but caution is warranted due to the overbought signals and the recent long liquidations contributing to market volatility.

Trading Strategy: Buy on Dips

Given the current market conditions, it may be a good strategy to buy on dips around $2, setting a stop loss at $1.60 and targeting a profit at $3.30. This approach allows traders to take advantage of potential upward movements while managing risk effectively.

Comment 0