Marathon Digital’s Growth: Driving Investor Confidence

Bitcoin (BTCUSD) is currently consolidating after reaching a new all-time high of $93,483, with prices trading around $95,123. Both MicroStrategy and Marathon Digital Holdings (MARA) have significantly increased their Bitcoin holdings, reflecting strong institutional interest as Bitcoin approaches new highs. MicroStrategy continues to accumulate Bitcoin, now holding about 1.8% of the total supply, showcasing its confidence in the cryptocurrency's long-term value. Meanwhile, MARA reported record production of 907 BTC in November and is actively raising $805 million to purchase more Bitcoin and reduce debt. Currently, MARA holds 34,959 BTC valued at around $3.3 billion, positioning both companies to benefit from the positive sentiment surrounding Bitcoin.

Whale Activity: Major Purchases Indicate Market Confidence

Bitcoin whales have made substantial purchases, accumulating approximately 16,000 BTC worth around $1.5 billion within just 24 hours. This buying spree occurred after a market dip that saw Bitcoin's market cap decrease by nearly $4 billion, indicating that whales capitalized on the lowered prices. As a result, total whale holdings now exceed 3.875 million BTC, reflecting strong confidence in Bitcoin’s long-term value. This trend suggests that large investors are preparing for potential price increases.

U.S. Bitcoin ETFs: Notable Inflows Amid Price Fluctuations

Over the past five days, U.S. Bitcoin ETFs experienced significant inflows totaling around $3.4 billion, driven by renewed investor interest as Bitcoin approached the $100,000 mark. Daily inflows included $103 million on November 27 and $320 million on November 29. However, this positive trend ended with a notable outflow of $438 million also on November 27, when Bitcoin's price dropped below $94,000, indicating a shift in market sentiment.

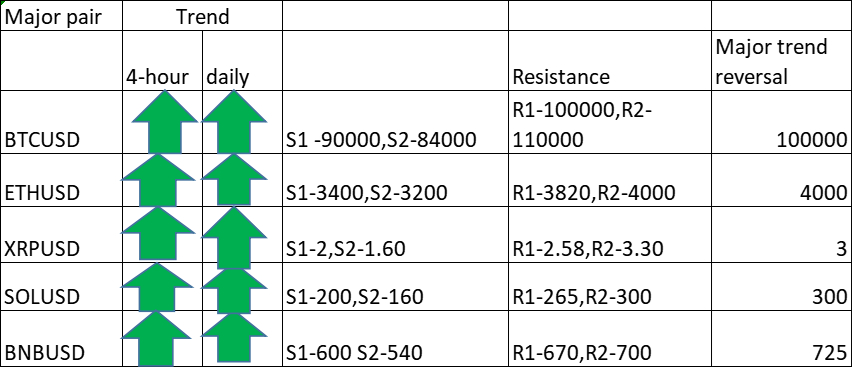

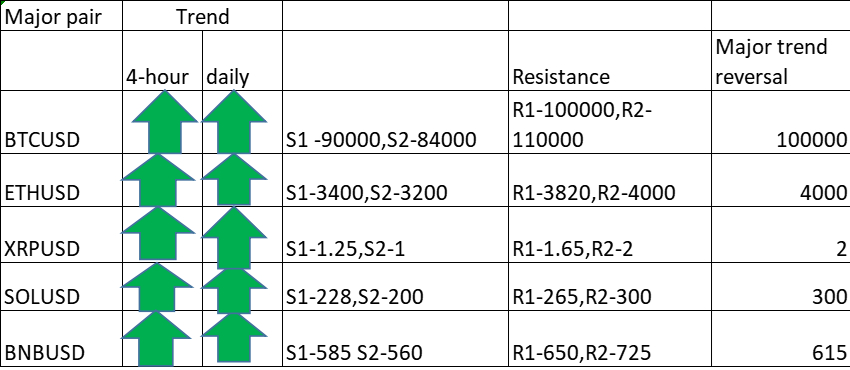

Technical Analysis: Key Levels and Trading Strategies

BTCUSD currently trades above both the short-term moving averages (34-EMA and 55-EMA) and the long-term moving average (200-EMA) on the daily chart. Minor support is identified at $90,000; a break below this level could lead to targets at $86,700, $84,000, $80,000, or $75,800. In a bullish scenario, the primary supply zone is identified at $98,000; breaking through this level would confirm intraday bullishness, with the potential to reach $100,000. A secondary barrier at $100,000 suggests that closing above this level could target $110,000. Indicators on the 4-hour chart, such as a bullish Commodity Channel Index (CCI) and Average Directional Movement Index, reinforce this positive outlook.

An investment strategy could involve buying on dips around $80,000, with a stop-loss set at $76,000, targeting a price of $100,000.

Comment 0