Pantera Capital CEO Dan Morehead predicts Bitcoin could soar to $740,000, fueled by favorable regulatory shifts and increasing institutional investments. Despite recent market fluctuations, Morehead remains optimistic about Bitcoin’s long-term growth potential.

Regulatory Tailwinds Position Bitcoin for $740K Surge

Dan Morehead, founder and CEO of Pantera Capital, recently made a statement predicting that Bitcoin's price may reach $740,000 in the future, according to Bloomberg.

Several important variables, according to Morehead, might propel Bitcoin's price to new heights, and this is where his prediction is based. Regulatory shifts are one of the main forces. The regulatory hurdles that have plagued Bitcoin for the past fifteen years are now beginning to work in its favor, as pointed out by Morehead.

In an interview, Morehead made the comment, "People totally thought we were crazy in 2013," referring to the year when Pantera Capital Management's Bitcoin fund was established 11 years ago. "There are still a lot of people very negative. And that’s why I’m so bullish. So many people are still negative. It’s far from being a bubble."

Rumor has it that American investors were initially introduced to Bitcoin through Pantera's inaugural fund, U.Today shares. When the fund was initially launched in 2013, the value of one Bitcoin was $74. Following a brief period near $100,000 at the weekend's close, it traded at approximately $92,000 on Tuesday. The value of Bitcoin has surged by over 100% so far in 2018.

Bitcoin’s Volatility and ETF Market Trends

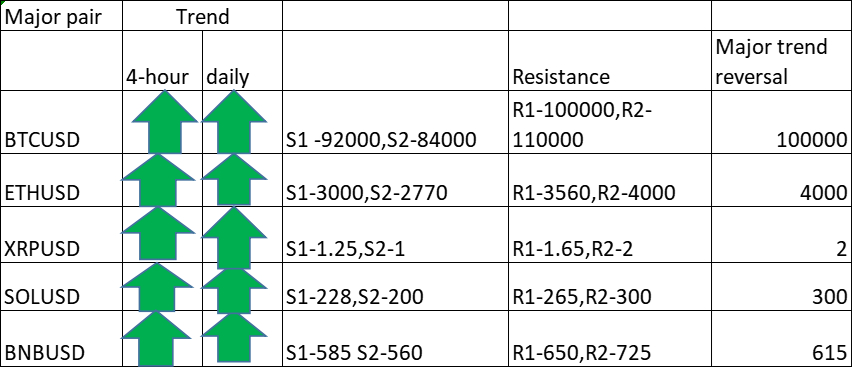

With today's trading session hitting a low of $91,420, Bitcoin continued its biggest losing streak in recent weeks, which began when it failed to cross $100,000. While the bitcoin market as a whole gained $1 trillion since November 5, part of that gain was lost.

Even if demand has decreased, about $7 billion has come into U.S. spot-Bitcoin exchange-traded funds since that date. On Monday, however, $438 million was pulled out.

According to CoinMarketCap data, the market capitalization of the largest cryptocurrency has decreased by 1.89% to $93,137.

MicroStrategy’s Record $5.4 Billion Bitcoin Investment

A growing number of long-term Bitcoin holders have begun selling their holdings on the spot market as the cryptocurrency continues to break new records this month. Bitcoin exchange-traded funds (ETFs) have seen inflows and MicroStrategy has made large purchases, offsetting the sell pressure.

On Monday, cryptocurrency hedge fund proxy MicroStrategy bought 5.4 billion Bitcoin, an all-time high. This is the third major acquisition for the crypto fund proxy this month.

Comment 0