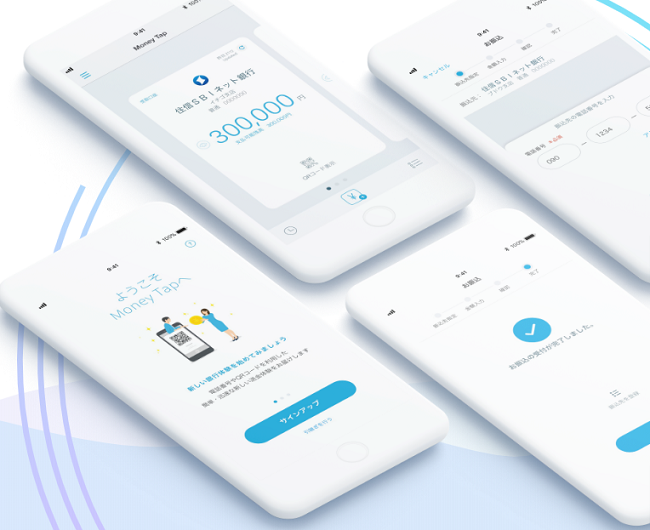

SBI Ripple Asia, a joint venture between blockchain startup Ripple and Japanese financial services giant SBI Holdings, last week announced the launch of a demonstration test of its Money Tap app that would allow in-store payments.

Launched last October, Money Tap offers real-time settlement for domestic payments in Japan. It uses xCurrent – Ripple’s enterprise software for messaging and international transaction settlement.

Money Tap “transfers money between individuals from a bank account to a bank account 24 hours a day, 365 days a year … in real time, safely and comfortably,” the press release said.

In the demo trials, users will be able to use the Money Tap app to make payments at affiliated stores using QR code. The trial will be initially launched at a restaurant at SBI Group’s headquarters located in Roppongi, Tokyo.

“Through this trial, we plan to verify various customer experiences (UX) and connect them to a full service within the year,” SBI said.

Using MoneyTap, users can send funds to others using their mobile phone number or QR code. The app uses devices biometric authentication, such as fingerprint scanning, for ensuring security.

In March 2019, SBI Group, together with 13 regional banks, established Money Tap Co., Ltd. Per the press release, Money Tap has completed registration as an electronic payment agent in Japan on May 28, 2019.

The app was initially supported by three Japanese banks – SBI Sumishin Net Bank, Suruga Bank, and Resona Bank. However, Resona Bank in April announced the cancellation of its cooperation with Money Tap without specifying the reason behind its decision.

Comment 0