Airdrops have become a popular marketing tool in the cryptocurrency space, but they often introduce price instability. Notcoin, which launched last May, is a prime example. While its market capitalization surged into the billions, rewarding early adopters, a lower initial cap might have prevented volatility and created more sustainable growth.

Following Notcoin’s success, imitators flooded the market, many shifting from “play-to-earn” to “pay-to-earn” models, which prioritized investors over users. The result: heavy selling pressure and falling prices. The key question: Who absorbs the supply when airdrop recipients sell? The answer: investors and traders. Without buy-side support, prices collapse.

Market Data Reveals Declines

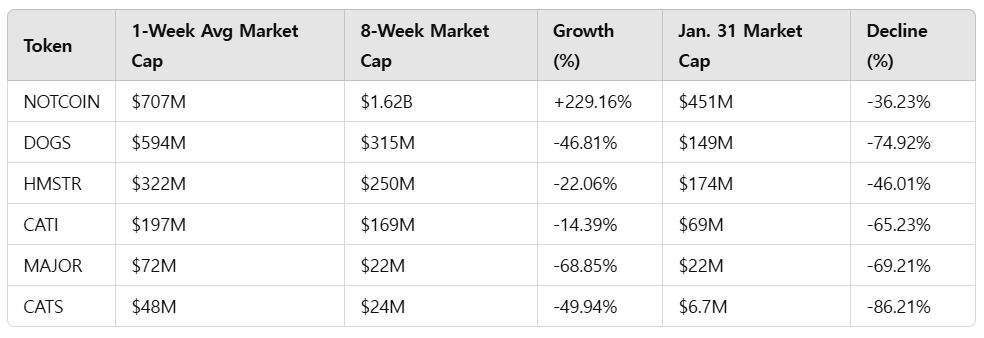

Recent market data shows diminishing returns from successive token launches:

The trend is clear: Each new launch has struggled to retain investor confidence, resulting in steep price declines and lower market caps.

Path to a Sustainable Recovery

To break the cycle, projects launching on TON must prioritize long-term value creation. Critical steps include:

-

Transparent price discovery to build trust.

-

Real-world utility to drive token demand.

-

Robust exchange listings to ensure liquidity.

-

Advanced trading tools to support market activity.

Looking Forward: Can TON Rebound?

A single breakout project could change the narrative, as seen with past successes on Solana and Ethereum. Improved infrastructure and smarter launches could help TON overcome the current "CEX-DROP-DEATH" pattern, renewing investor interest and fostering a healthier ecosystem.

The question remains: Which project will lead the way?

Comment 0