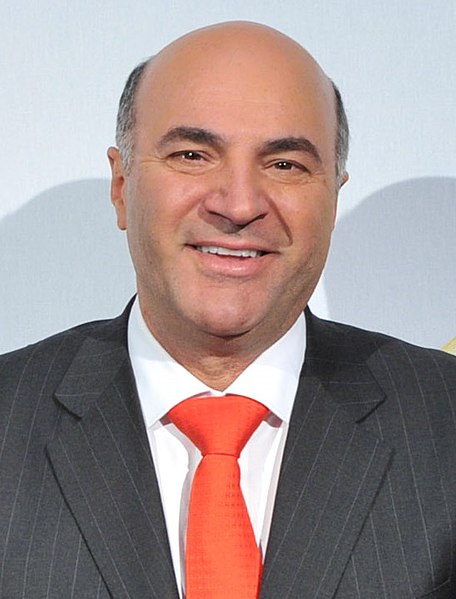

Shark Tank star Kevin O’Leary has a different explanation for why the crypto exchange FTX failed, which he shared with U.S. senators. O’Leary told U.S. Congress that the reason for FTX’s failure was because rival Binance intentionally put it out of business.

The Shark Tank star shared his views on the collapse of the crypto exchange FTX on Wednesday during a congressional hearing titled “Crypto Crash: Why the FTX Bubble Burst and the Harm to Consumers,” which was held before the Senate Committee on Banking, Housing, and Urban Affairs. “Why do you believe FTX failed?” O’Leary was asked by Senator Pat Toomey (R-PA), Bitcoin.com reported.

“I have an opinion. I don’t have the records,” O’Leary replied. He narrated his interaction with former FTX CEO Sam Bankman-Fried (SBF) after he noticed that funds disappeared from his FTX accounts.

“After my accounts were stripped of all of their assets and all of the accounting and trade information, I couldn’t get answers from any of the executives in the firm, so I simply called Sam Bankman-Fried and said, ‘Where is the money, Sam?’,” O"Leary said.

Bankman-Fried told O’Leary that he “no longer knew” because SBF was already “refused access to the servers,” according to the Shark Tank star. “This is a simple case in my mind of ‘where did the money go?” he told the Senate committee.

O’Leary then asked SBF to explain how the process from FTX’s assets was used over the past 24 months. He learned about a transaction worth between $2 billion and $3 billion to repurchase the company’s (FTX) shares from Binance.

“I didn’t know this at the time, but at some point, CZ [Changpeng Zhao], who runs Binance, purchased 20% ownership in Sam Bankman-Fried’s firm for seed stock,” O’Leary told the Senate Committee. “What would compel you to do that? Why wouldn’t you keep your assets on the balance sheet?” he asked SBF.

SBF told O’Leary that every time FTX applied for a license in various jurisdictions, Binance and CZ “would not comply with the regulators’ requests to provide the data that would clear [FTX] for a license.”

FTX’s decision to spend around $3 billion to buy back its shares from Binance stripped the firm’s balance sheet of assets. “In my view, my personal opinion, these two behemoths that own the unrelated market together, and grew these incredible businesses in terms of growth, were at war with each other,” he added.

“One put the other out of business intentionally. Maybe there’s nothing wrong with that … but Binance is a massive unregulated global monopoly now. They put FTX out of business,” he concluded.

Comment 0