Crypto industry players are now facing increased scrutiny from U.S. regulators. However, a Commodity Futures Trading Commission (CFTC) commissioner has criticized regulators for enforcing punitive actions such as fines for violating crypto rules without issuing clear guidance about those rules.

In an interview with the Financial Times, CFTC Commissioner Dawn Stump noted that it’s becoming commonplace for regulators including her own agency to punish firms without giving them the necessary guidance for compliance. “What I discourage here at the CFTC is bringing enforcement actions without giving [crypto firms] the tools they need to be compliant,” she said.

The CFTC Commissioner criticized U.S. regulators for what she calls regulating through enforcement. “I think there’s a lot of that happening now,” she added.

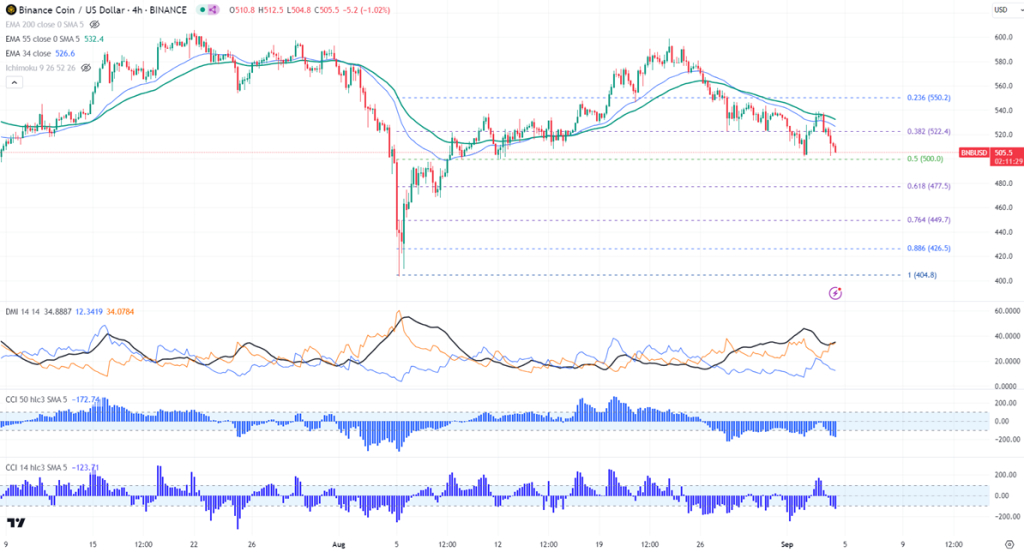

Stump cited the case of the crypto exchange Kraken as one example of enforcement coming before proper rulemaking, according to Coindesk. In September, the CFTC fined the San Francisco-based exchange $1.25 million for its failure to register as a futures broker.

The CFTC said that Kraken broke the law when the crypto exchange offered “margined, leveraged or financed digital asset trading to U.S. customers” between June 2020 and July 2021, according to PYMNTs.com. The agency pointed out that Kraken was not a designated contract market and did not register as a futures commission merchant (FCM).

“We’ve never designed a regulation that explains to these entities how they could achieve that registration,” Stump explained. “I would have preferred that we would not have brought those types of cases until we had better defined how they might achieve compliance.”

Stump pointed out that it was unclear how Kraken could have registered as an FCM at that time. “Many of the Commission’s rules governing its regulation of traditional FCMs do not fit Kraken’s role as an exchange,” she added.

Comment 8