Companies and individuals have been buying Bitcoin (BTC) and other cryptos as a hedge against inflation. In fact, people have even compared BTC to gold for its store of value and as a safe-haven asset.

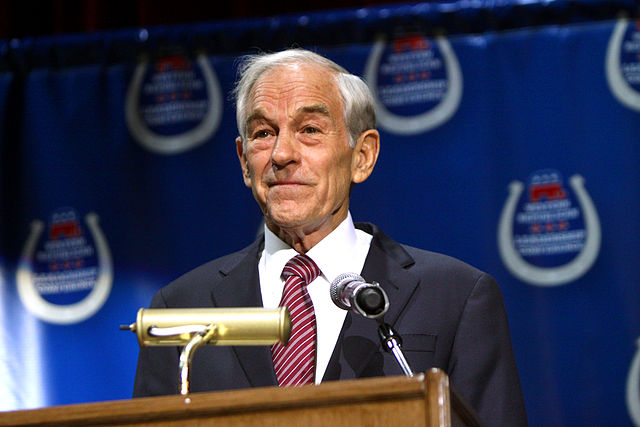

However, former Congressman Ron Paul warned that Bitcoin, gold and other safe-haven assets might not be that safe at all. According to Paul, the threat this time might come from government intervention, according to Bitcoin.com.

In an interview with Kitco New’s Michelle Makori, Ron Paul shared his views on the government’s potential intervention on Bitcoin. Paul is also a former presidential candidate, an author, physician, and the host of The Liberty Report.

Makori mentioned that “The Big Short” investor Michael Burry and Bridgewater Associates founder Ray Dalio have raised concerns that safe-haven assets are not necessarily safe from possible government intervention. “They expect possible tax changes or regulations that will prevent a flight of capital to these assets that could be viewed as an alternative to the dollar, like gold, like Bitcoin,” Makori asked Paul, “Could they be at risk of a government crackdown?”

Paul replied that the threat from the government to these assets will always be there. “Absolutely… the government is the threat because they will crackdown because they have the ability to do it,” he said.

Makori then asked Paul what kind of government crackdown might happen. “What form of a crackdown do you think this could take when we talk about assets, like gold and even Bitcoin, potentially being at risk of government intervention at higher taxes and regulation … what do you think could happen to those assets?” she questioned the author.

“I think all of that can happen,” Paul told Makori. He explained that the government might either use the tax system or simply print more money, which could end up devaluing the U.S. dollar.

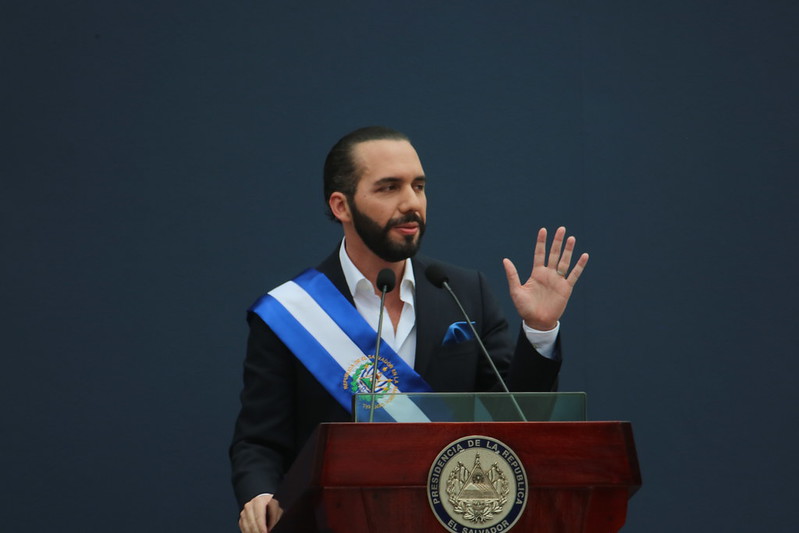

Last month, Bridgewater Associates founder and chief investment officer Ray Dalio warned that shocking taxes or prohibitions could be coming to Bitcoin and other assets. “f history and logic are to be a guide, policymakers who are short of money will raise taxes and won’t like these capital movements out of debt assets and into other storehold of wealth assets and other tax domains so they could very well impose prohibitions against capital movements to other assets (e.g., gold, Bitcoin, etc.) and other locations. These tax changes could be more shocking than expected,” he said.

Comment 5