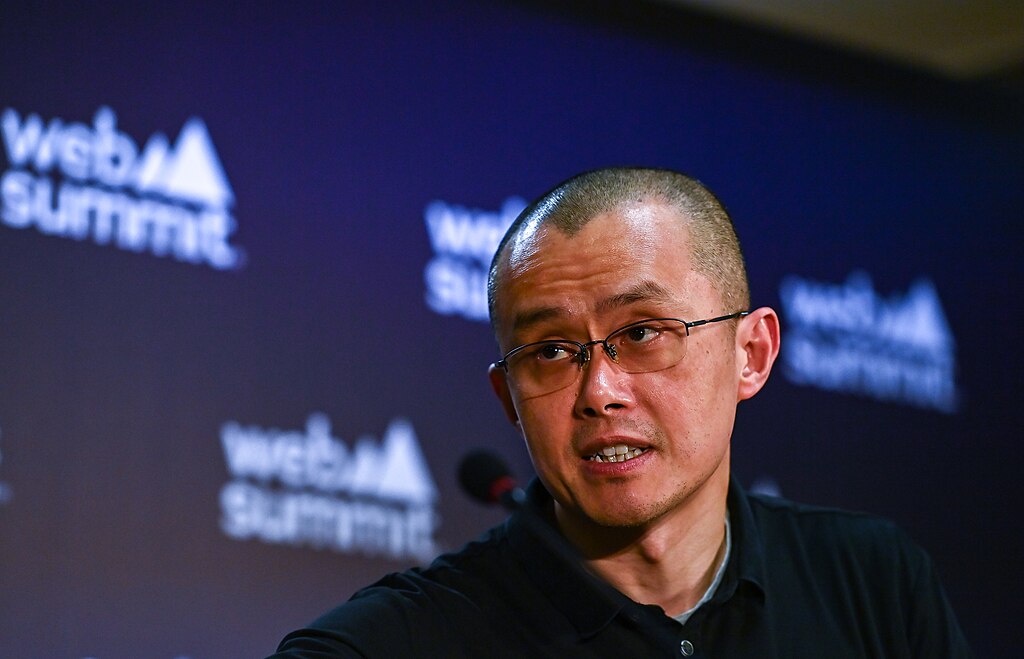

Changpeng Zhao (CZ), the co-founder and former CEO of Binance, recently praised BlackRock’s spot Bitcoin ETF, IBIT, calling it the "fastest-growing ETF in history." Taking to X, he reacted to data showing BlackRock’s massive Bitcoin holdings, currently valued at over $54.25 billion, according to Arkham Intelligence.

Launched in January 2024, IBIT has quickly gained traction. Recent data from @lookonchain revealed a $38.9 million (432 BTC) inflow into BlackRock’s ETF, reinforcing its dominance in the market. The updated figures indicate that BlackRock now holds approximately $51.57 billion worth of Bitcoin.

Grayscale’s Bitcoin Mini Trust followed closely behind with an inflow of 412 BTC, valued at $36.45 million. However, other Bitcoin ETFs struggled, facing significant outflows. Fidelity and Ark Invest recorded zero inflows, while Bitwise lost 76 BTC. Invesco Galaxy and Grayscale saw marginal declines of 9 BTC and 8 BTC, respectively. Valkyrie’s Bitcoin Fund experienced the largest outflow, shedding 670 BTC worth approximately $59.3 million.

CZ’s remarks highlight the growing institutional interest in Bitcoin ETFs, with BlackRock’s IBIT leading the pack. As demand surges, the ETF’s rapid growth signals a shift in mainstream adoption, solidifying Bitcoin’s role in the financial markets.

Comment 0