Grayscale Investments has just launched a new DeFi fund. With its launch, the world’s largest digital asset manager now offers 15 crypto investment products to its clients.

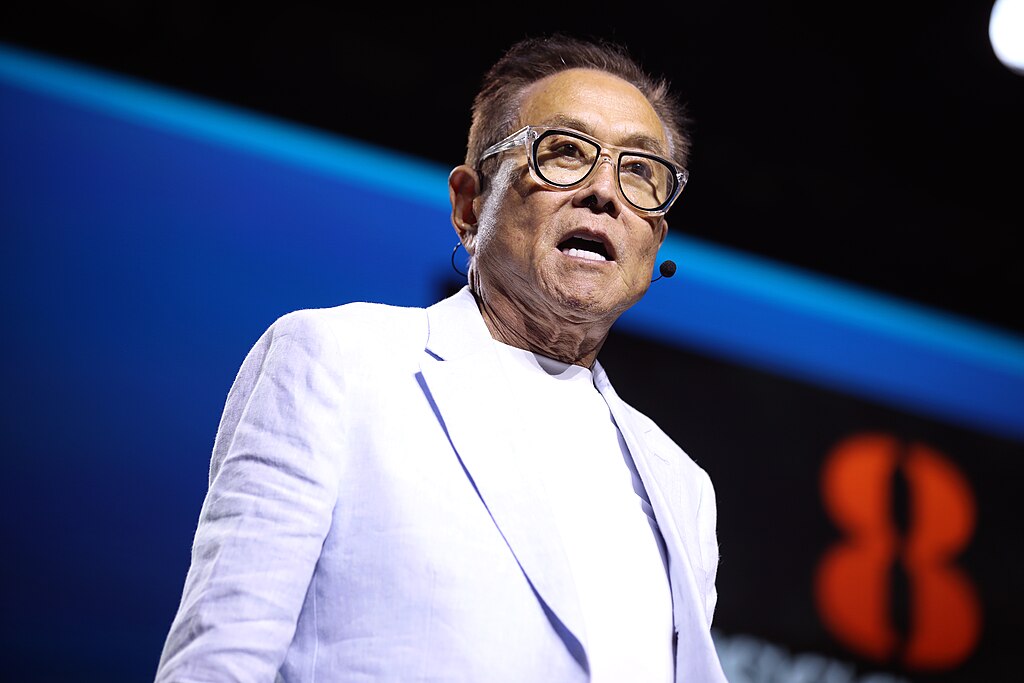

Grayscale CEO Michael Sonnenshein, in an interview with CNBC’s “Squawk Box,” said that his company has seen interest for DeFi assets from a broad base of its existing clientele. To meet this demand, the firm created the institutional-grade DeFi fund.

Sonnenshein said that the fund will give investors broad-based exposure to multiple DeFi protocols through a single investment vehicle. As of July 14, the fund is comprised of uniswap (UNI) at 49.95%, aave (AAVE) at 10.25%, compound (COMP) at 8.38%, curve (CRV) at 7.44%, makerdao (MKR) at 6.49%, sushiswap (SUSHI) at 4.83%, synthetix (SNX) at 4.42%, yearn finance (YFI) at 3.31%, UMA protocol (UMA) at 2.93%, and bancor network token (BNT) at 2.00%, Bitcoin.com.

The DeFi fund’s market capitalization-weighted portfolio is designed to track the Coindesk Defi Index. The fund is now open for daily subscriptions by eligible individual and institutional investors.

“The Grayscale Defi Fund is Grayscale’s fifteenth investment product, and its second diversified fund offering,” Grayscale CEO Michael Sonnenshein said.

Grayscale Large Cap Fund, the firm's other diversified fund, recently became an SEC reporting company. It also added the cryptocurrency Cardano (ADA) recently, which became its third-biggest component.

Aside from the two diversified funds, Grayscale’s 13 other investment products are the Bitcoin Trust (GBTC), Basic Attention Token Trust, Bitcoin Cash Trust, Chainlink Trust, Decentraland Trust, Ethereum Trust, Ethereum Classic Trust, Filecoin Trust, Horizen Trust, Litecoin Trust, Livepeer Trust, Stellar Lumens Trust, Zcash Trust, and the Digital Large Cap Fund.

Sonnenshein also said that the company is “100% committed” to transforming the Grayscale Bitcoin Trust ($GBTC) into an ETF once conditions are right. While the SEC is yet to approve a single exchange-traded fund, he believes that a U.S. ETF is a matter of “not ‘if,’ but ‘when.’”

“I think in our seat, from our view of the world, we’re really looking for a couple of different points of maturation in the underlying market, and that’s really the final stages of what we think regulators need to approve those types of products and give investors the protections that they’re looking for,” he said.

Comment 5