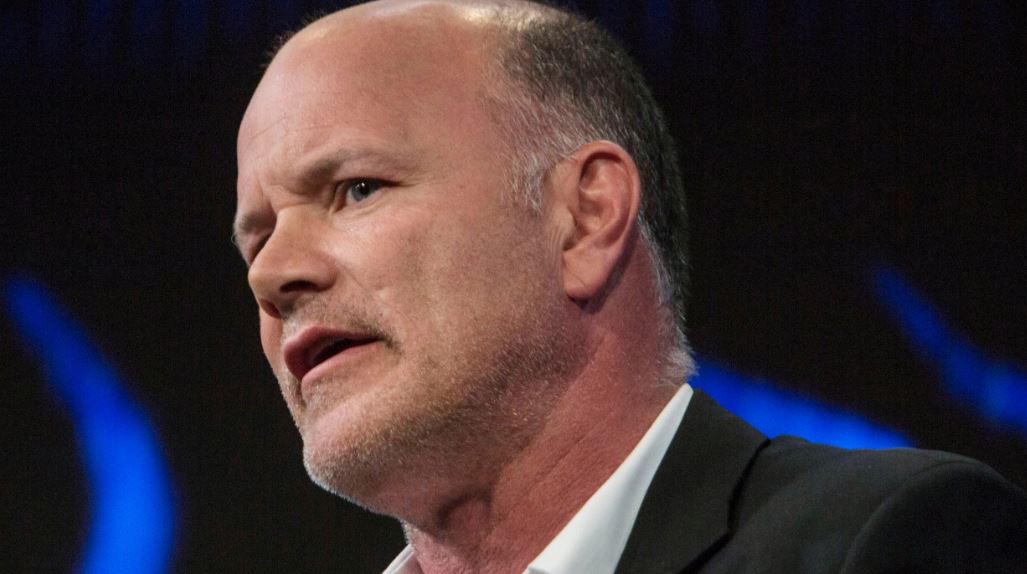

Cryptocurrency investor Michael Novogratz is a known Bitcoin bull. In fact, he predicted a few months back that BTC’s price will reach $20,000 by the end of 2020.

Despite believing in the Bitcoin price’s eventual rise, he does not want cryptocurrency investors to place the majority of their funds into BTC. Novogratz says it is safer to buy more gold than Bitcoin at the moment, according to Cointelegraph.

While he believes that BTC will post a better market performance compared to gold, the cryptocurrency is just too volatile that it’s best not to put all their investments into the token. “My sense is that Bitcoin way outperforms gold, but I would tell people to have a lot less Bitcoin than they have gold, just because of the volatility,” Novogratz said on CNBC’s “Fast Money” on July 8.

Novogratz explained that will Bitcoin usage is gaining momentum, it is “still early in the adoption cycle” and hard to obtain. “Bitcoin is still hard to buy. If it was easier to buy, it would be a lot higher,” the investor added. “And there are more and more people making it easier to buy: funds being set up, custodies being done, at one point we’ll get an ETF.”

Gold’s price has been inching higher recently and even established a nine-year high. This happened on July 9 when it breached the $1,800 mark, establishing the precious metal’s highest price since September 2011.

While gold is doing well recently, Novogratz believes that Bitcoin will outperform the precious metal this year. In fact, he predicted that BTC will likely rice to $20,000 by the end of the year.

“This is the year of Bitcoin and if it doesn’t go up now by the end of the year, I might just hang my spurs,” Novogratz said on CNBC “Closing Bell” on April 2, according to Blockonami.

It’s not only Novogratz who expect BTC to rally soon. Former Wall Street trader turned head of the crypto fund Pantera Capital Dan Morehead also believes that the cryptocurrency will set a new record in the next 12 months.

“My best guess is that it will take institutional investors 2–3 months to triage their current portfolio issues,” Morehead said. “Another 3–6 months to research new opportunities like distressed debt, special situations, crypto, etc. Then, as they begin making allocations, those markets will really begin to rise.”

Comment 6