Bitcoin dropped 1.3% to $96,368.1 on Monday as investors assessed U.S. inflation data and awaited remarks from Federal Reserve officials. The cryptocurrency continues to face volatility amid concerns over prolonged monetary policy tightening.

The U.S. Consumer Price Index (CPI) for January showed inflation remaining above the Fed's 2% target, prompting fears that interest rates may stay elevated longer. Higher interest rates often reduce investor appetite for risk assets, including cryptocurrencies.

Investors are keenly watching upcoming comments from Fed officials for signals on future rate decisions. Prolonged high rates could further pressure Bitcoin, which historically struggles in such environments. The market remains uncertain, with Bitcoin trading within a tight range as it seeks direction from macroeconomic cues.

Adding to bearish sentiment, crypto ETFs have seen significant outflows recently due to profit-taking after Bitcoin's rally earlier this year, regulatory concerns, and a broader risk-off sentiment in traditional markets. These outflows indicate that both institutional and retail investors are scaling back on crypto exposure amid economic uncertainties.

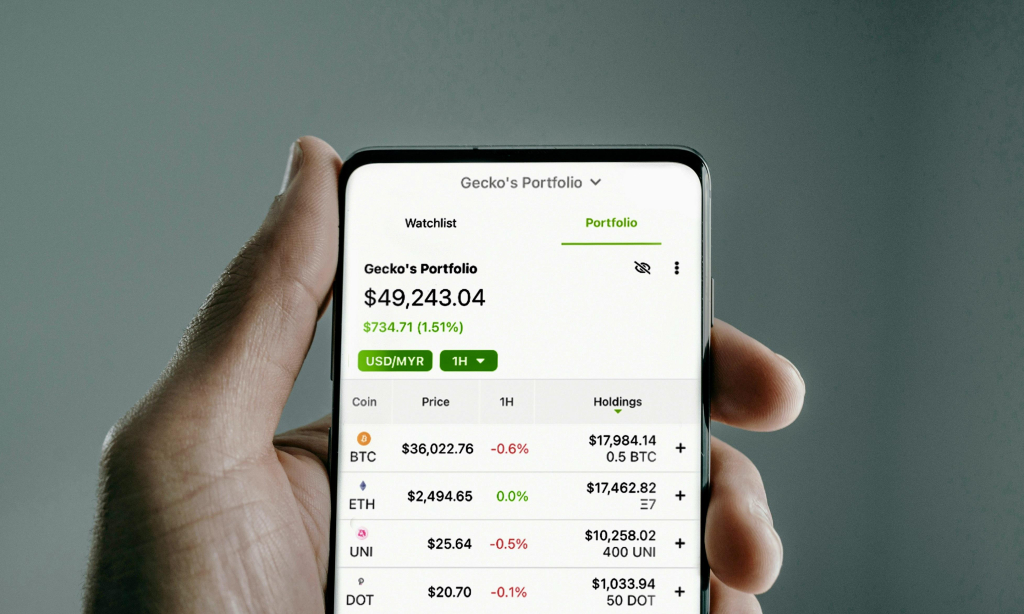

Altcoins mirrored Bitcoin's decline. Ethereum fell 1.1% to $2,680.19, XRP dropped 4.1% to $2.6724, and Solana declined 6.2%. However, Cardano bucked the trend, rising 3.1%. Meme tokens like Dogecoin fell 3.2%, while $TRUMP slipped 5.7%.

As the crypto market navigates economic challenges, investors remain cautious, closely monitoring inflation data and Fed policies for future market direction.

Comment 0