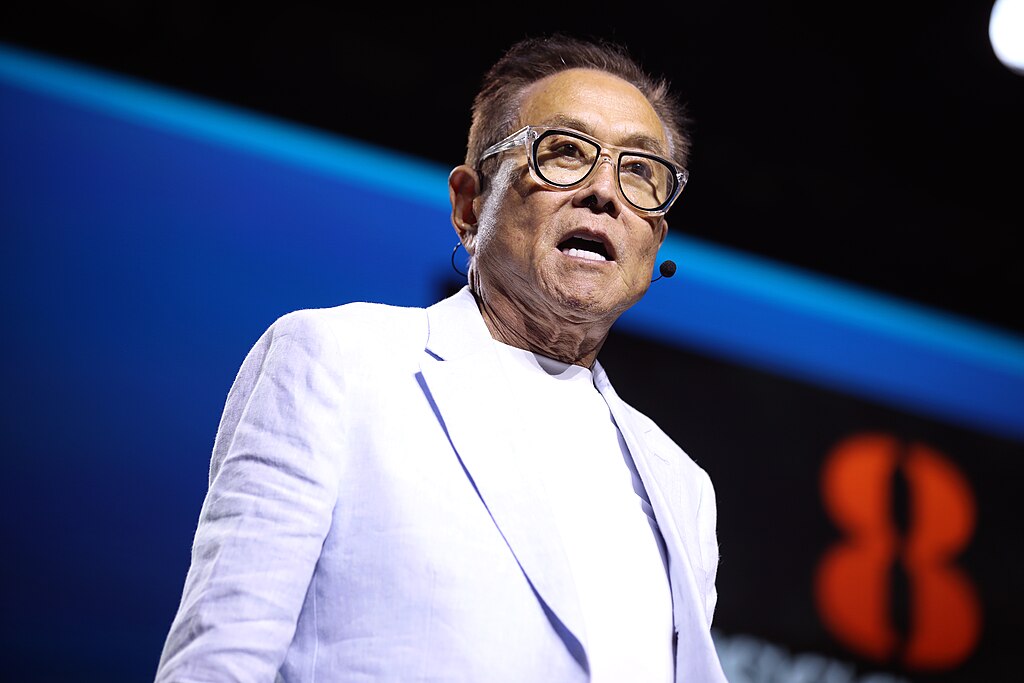

Renowned investor and Rich Dad Poor Dad author Robert Kiyosaki recently took to X (formerly Twitter) to discuss Bitcoin, answering a common question from his followers. He reaffirmed his belief in Bitcoin and gold as superior assets compared to fiat currencies like the U.S. dollar.

Kiyosaki, a long-time critic of traditional financial systems, revealed he has purchased more Bitcoin and gold, emphasizing their reliability as safe-haven assets. He argues that holding fiat currency is riskier due to inflation and declining purchasing power. Some users countered his stance, suggesting Litecoin as an alternative investment, given Kiyosaki’s affinity for silver. Others pointed out that Bitcoin is still denominated in U.S. dollars, which he frequently criticizes.

Bitcoin recently dipped below the $100,000 mark, dropping by 4.25% in 24 hours to $96,145. It had briefly reclaimed $100,000 after a weaker-than-expected non-farm payrolls report but soon declined again. On Feb. 3, Kiyosaki addressed this downturn, declaring that the anticipated market crash had arrived, affecting stocks, bonds, real estate, and commodities. He described the price dip as a prime buying opportunity, stating, “This is the best time to get rich.”

The market plunge saw Bitcoin fall from $98,000 to $92,200, reinforcing Kiyosaki’s belief that such corrections present golden opportunities for investors. Known for his preference for hard assets, he continues to advocate for Bitcoin, gold, and silver as long-term wealth preservation tools.

His perspective aligns with his broader philosophy: while traditional markets face uncertainty, alternative assets like Bitcoin provide a hedge against financial instability.

Comment 0