In the past 24 hours, leveraged cryptocurrency positions worth $983.58 million have been liquidated.

As of 8:05 a.m. on the 20th, data from CoinGlass shows that 342,761 traders experienced liquidations totaling $983.58 million across the cryptocurrency market. Of this, $733.71 million (75%) were long positions, while $249.87 million were short positions.

Over a 12-hour period, liquidations amounted to $597.78 million, with long positions accounting for 78%. In the last four hours, $410.88 million worth of positions were liquidated, of which 88% were long positions.

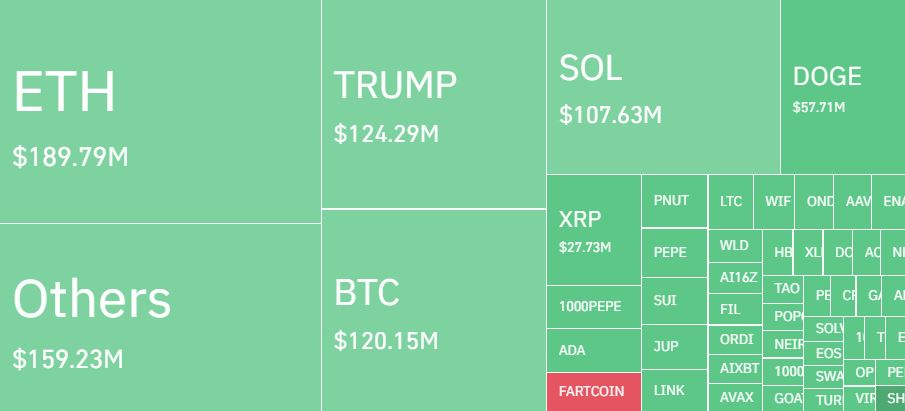

Ethereum positions experienced the highest liquidation volume, totaling $189.79 million (19%) within the day. Long positions made up $139.60 million or 74% of this amount.

Other cryptocurrencies followed, with liquidation volumes totaling $159.23 million (16%), where long positions accounted for $143.40 million or 90%. Trump ($TRUMP) token positions ranked next, with $124.29 million liquidated, followed by Bitcoin positions at $120.15 million. Both were predominantly long positions.

The largest single liquidation event occurred on Binance, where an ETHUSDT position worth $9.5 million was forcibly closed.

Binance led in terms of liquidation volume among exchanges, with $367.95 million (37.41%) of positions liquidated, 77.43% of which were long. OKX followed with $256.24 million (26.05%, 72.39% long), and Bybit ranked third with $159.42 million (16.21%, 79.53% long).

In derivatives markets, “liquidation” occurs when the market moves against a position, resulting in losses that exhaust the trader’s margin, leading to the forced closure of the position.

As of 8:05 a.m. on the 20th, Bitcoin was trading at $101,764, down 2.43%, while Ethereum fell 2.07% to $3,216, according to CoinMarketCap.

Comment 0