Market fears over a potential sell-off of Bitcoin seized by the U.S. government from the dark web marketplace Silk Road are exaggerated, according to an analysis by CoinDesk senior analyst James Van Straten.

Recent reports revealed that the U.S. Department of Justice (DOJ) had obtained the authority to sell 69,370 BTC (approximately $6.5 billion) confiscated from Silk Road. This prompted concerns about the potential impact of such a large sale on the market.

Van Straten argued that these concerns are overstated, citing the Bitcoin market's capacity to absorb similar large-scale sales, such as the German government's sale of 50,000 BTC in 2023. He noted that large liquidations, when conducted, are likely to be orderly to maintain the best possible prices.

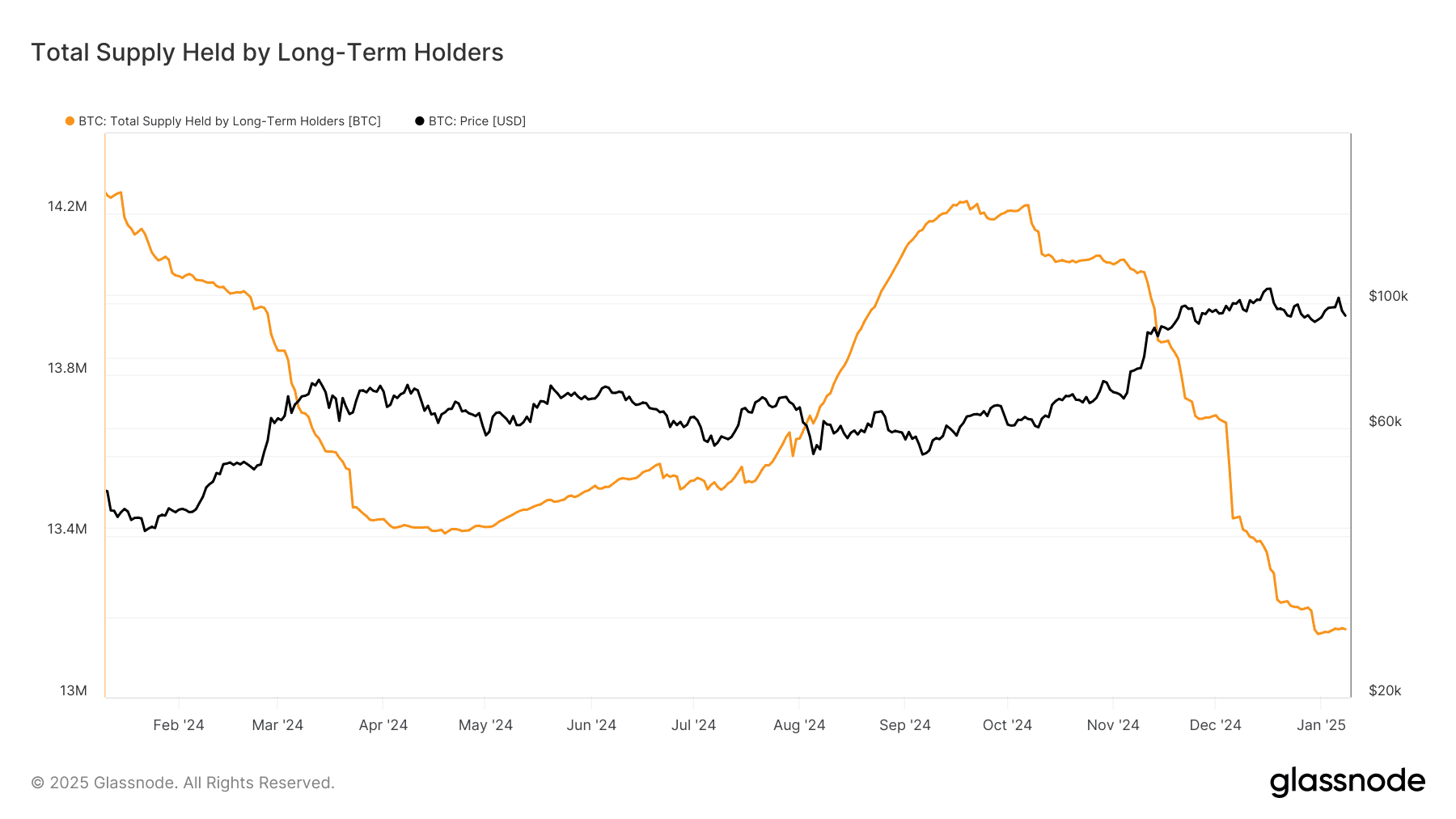

“The market is already aware of the Silk Road Bitcoin seizure, and some of these concerns may have been priced in,” Van Straten said. He also pointed out that the market has absorbed over 1 million BTC sold by long-term holders (holding for 155+ days) since September while maintaining price stability.

Van Straten highlighted that the Bitcoin supply held by long-term holders has decreased to 13.1 million since September, yet Bitcoin's price has risen from $60,000 to over $100,000.

Using data from similar government Bitcoin sales, Van Straten suggested the market reaction to the U.S. government’s sale would likely be manageable. For instance, in mid-2023, the German government sold 50,000 BTC worth $3.5 billion at the time—half its current value. Despite the sale, the market stabilized shortly thereafter, with Bitcoin finding a bottom at $55,000 on July 7, 2023, even as Germany retained 25,000 BTC.

“This shows that even large-scale sales of this magnitude do not dictate the market,” Van Straten said.

The news comes just 11 days before the inauguration of President-elect Donald Trump, who previously stated that the government would not sell its Bitcoin holdings. According to Glassnode data, the U.S. government currently holds 187,236 BTC from seizures related to Silk Road and Bitfinex.

Trump’s stance against selling the confiscated Bitcoin has reassured some investors, further reducing concerns about immediate market disruption.

Comment 0