Over the past 24 hours, the cryptocurrency leverage market witnessed liquidations worth approximately $849.1 million, impacting 215,455 traders, according to data from CoinGlass as of 8:17 a.m. on January 9.

Long positions accounted for the majority of liquidations, totaling $445.66 million (77%), while short positions represented $135.56 million. Within a 12-hour period, $361.41 million was liquidated (73% from longs), while the past 4 hours saw $56.22 million in liquidations, primarily from short positions (85%).

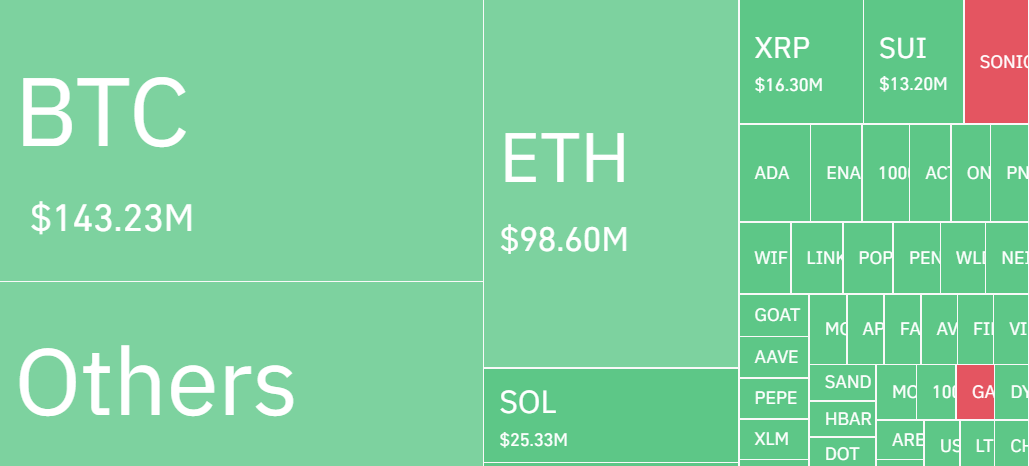

Bitcoin positions led the liquidations, with $143.23 million (25%) wiped out, of which $104.53 million (73%) came from long positions. Other cryptocurrencies followed, with $130.11 million (22%) in liquidations attributed to various altcoins, with long positions making up 91% ($118.78 million). Ethereum ranked third with $98.60 million in liquidations, predominantly long positions, followed by Solana at $25.33 million, mostly longs.

The largest single liquidation event occurred on OKX, where a BTC-USDT-SWAP position worth $15.56 million (₩22.73 billion) was forcibly closed.

Binance led the exchanges in total liquidations, processing $248.11 million (42.69% of the total), with 76.13% from longs. OKX followed with $162.15 million (27.90%, 70.5% longs), and Bybit came in third with $113.73 million (19.57%, 82.04% longs).

In the derivatives market, liquidation refers to the forced closure of positions when traders' margin balances are insufficient to cover losses from adverse price movements. This often happens in high-leverage environments, where even minor market fluctuations can lead to significant losses.

As of 8:17 a.m. on January 9, Bitcoin was trading at $94,988, down 1.99%, while Ethereum was down 1.73% at $3,321.00, according to CoinMarketCap. The data underscores the volatile nature of the cryptocurrency market, particularly in leveraged trading.

Comment 0