As the U.S. market closed, Bitcoin’s value showed promise by momentarily surging past $35,000 before settling slightly lower. Now, as the Asian markets open their doors, the cryptocurrency has surged by 12%, positioning itself close to the $35,000 mark once again.

According to data compilations from TradingView and CoinDesk, Bitcoin's current value floats above $34,000. Their Bitcoin Trend Indicator has pointed to a notable upward trajectory, fueling hope for the imminent reality of a Bitcoin ETF.

A recent analysis from Bernstein pinpointed a major catalyst behind the climb. The investment firm highlighted that the recent integration of BlackRock's proposed Bitcoin ETF into the Depository Trust & Clearing Corporation database under the symbol $IBTC has likely sparked this momentum.

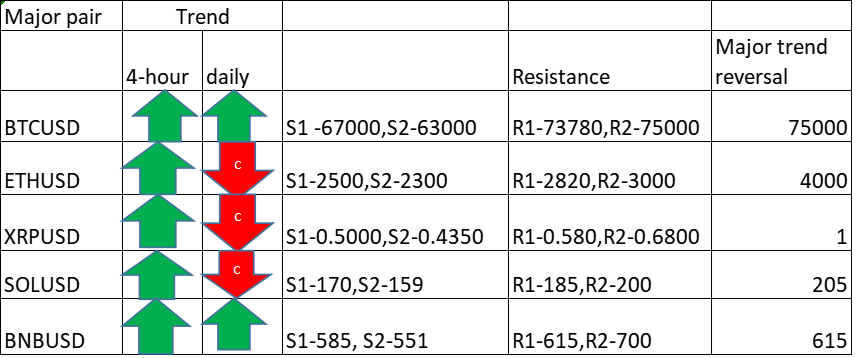

Jack Tan from Woo Network conveyed his perspective to CoinDesk, expressing that Bitcoin's current performance might be just the tip of the iceberg. He forecasted that if ETFs secure approval, Bitcoin could witness prices soaring as high as $75,000 in the near future. Moreover, he reflected that the positive sentiment surrounding the prospective approval has been influencing the market since the coin hit the $25,000 benchmark earlier this year.

However, the broader crypto market displays a diverse narrative. Altcoins, as per Tan, appear to be aligning more with the behavior of tech equities and might not showcase the resilience that Bitcoin does. He anticipates a subdued performance from them, while projecting ether to sync its growth with Bitcoin eventually.

David Lo from Bybit also chimed in, pointing out the prevailing dominance of Bitcoin in the current market environment, which has been unmatched since early 2021. He suggested that the market might witness a selling wave for GBTC soon, given the decreasing discount gap.

Commenting on the broader implications, Quinn Thompson from Maple Finance drew parallels between Bitcoin and the historical role of gold. He remarked that, akin to gold's previous standing, Bitcoin is gradually becoming the preferred hedge against economic uncertainties.

Thompson's views align with BlackRock CEO Larry Fink, who characterized the surge in crypto as a shift towards dependable assets, especially given global challenges. Thompson emphasized that such strong endorsements wouldn't emerge unless there were optimism regarding ETF approvals.

Comment 0