The uneventful market behavior of Bitcoin (BTC), the top-ranking digital asset, marked yet another day of a subtle crypto dance, as it flirted with a higher range before finding comfort under the $30,000 mark. A mere 0.3% increment settled the iconic cryptocurrency at around $29,899.

Hovering near its lowest point in the week, Ether (ETH), the second in command in the crypto realm, mirrored a similar apathy. Other key players in the digital arena, like SOL and XRP, rallied a bit to curtail their previous losses of the day.

In contrast, the governance token of the decentralized finance lender MakerDAO staged a captivating show, defying the generally dull market with a two-digit spike. This impressive performance can be attributed to the recent activation of a token buyback program.

Meanwhile, the lesser-known token CNC tumbled a whopping 75% due to an exploit involving Conic Finance that cost around $3.2 million. Conic Finance operates alongside Curve in the decentralized finance protocol ecosystem.

The slight rise gauges the overall performance of several digital assets, underscores the lukewarm trading activity of the day. All eyes are now on the upcoming potential interest rate hike by the Federal Reserve and the impending expiry of Bitcoin options next week.

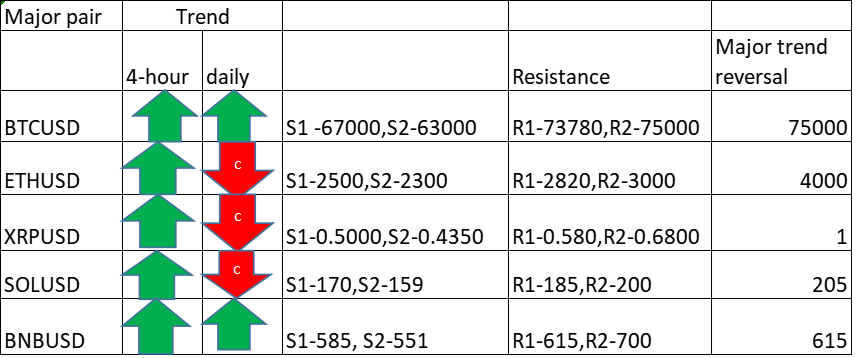

Decentralized derivatives exchange SynFutures' CEO and co-founder, Rachel Lin, observed that the crypto community started the week on a high note with optimism stemming from a favorable ruling in the Ripple-SEC case. Yet, the refusal of BTC and ETH to surge past resistance resulted in a dampened market spirit.

Looking at the brighter side, Lin emphasized that the crypto landscape is fundamentally bullish with a continual influx of money. If BTC breaks through the $31,400 ceiling, it could potentially ascend to $33,900, marking a brief reversal.

On the flip side, WisdomTree's head of digital assets, Will Peck, finds it challenging to forecast a near-term bitcoin price. He hinted at the uncertain implications of the SEC's approval of a spot bitcoin ETF.

Comment 0