Increasing institutional participation has been cited as one of the catalysts for the crypto market’s rally as more companies opted to hold Bitcoin as a reserve asset. Despite BTC’s popularity, St. Louis Federal Reserve President James Bullard believes that the cryptocurrency won’t eclipse the dollar in international finance.

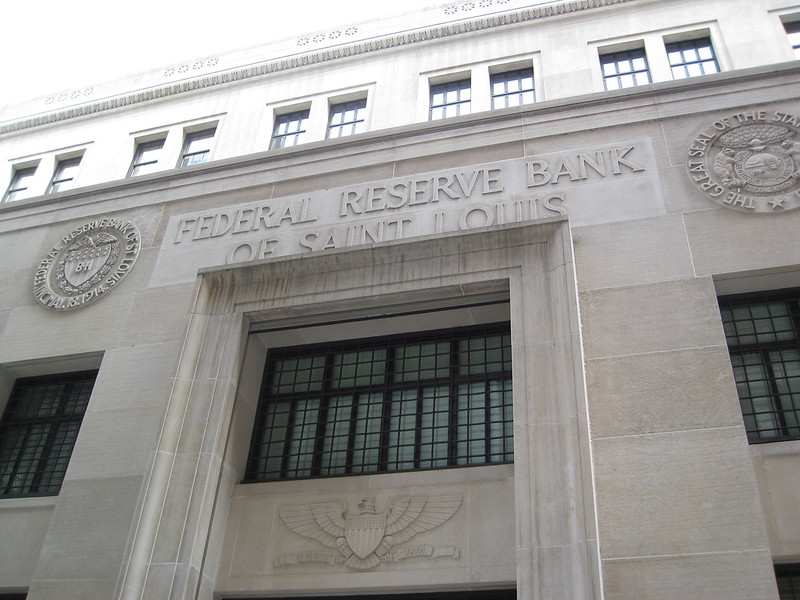

James Bullard said Bitcoin does not pose a threat to the U.S. dollar’s status as the world’s reserve currency despite the increasing interest in the crypto and its soaring price, Bitcoin.com reported. Bullard is the president of the Federal Reserve Bank of St. Louis since 2008 and is also an economist.

“I just think for Fed policy, it’s going to be a dollar economy as far as the eye can see — a dollar global economy really as far as the eye can see — and whether the gold price goes up or down, or the bitcoin price goes up or down, doesn’t really affect that,” Bullard said on CNBC’s “Squawk Box” on Tuesday.

Bitcoin is becoming more popular among companies for its store of value and as a hedge against the expected inflation due to pandemic-related money printing activities by governments. Cryptocurrency is also increasingly used for cross-border transfers and as a means of payment for goods and services.

However, he expressed his concern about using cryptocurrencies not issued by governments. “Dollars can be traded electronically already, so I’m not sure that’s really the issue here,” the Fed president added. “The issue is privately issued currency.”

He likened the current crypto situation to what happened before the Civil War when banks such as JPMorgan, Wells Fargo, and Bank of America issued their own notes. The system did not last and he fears the same might happen to cryptos such as Bitcoin.

“They were all trading around and they traded at different discounts to each other, and people did not like it at all,” Bullard said. “I think the same thing would occur with bitcoin here.”

Bullard argued that people will eventually prefer a uniform currency instead of a dazzling array of payment options. “You don’t want to go to a nonuniform currency where you’re walking into Starbucks and maybe you’ll pay with ethereum, maybe you’ll pay with ripple, maybe you’ll pay with bitcoin, maybe you’ll pay with a dollar,” he explained. “That isn’t how we do this. We have a uniform currency that came in at the Civil War time.”

He also does not believe that Bitcoin could threaten the greenback’s reserve currency status as even strong currencies such as the euro and the yen weren’t able to do so. “It’d be very hard to get a private currency that’s really more like gold to play that role so I don’t think we’re going to see any changes in the future,” Bullard said.

In January, Former Canadian Prime Minister Stephen Harper also said that Bitcoin isn’t likely to replace the dollar. However, the crypto can become an alternative reserve currency.

“Unless the U.S. becomes a catastrophe, it’s hard to see what the alternative is to the U.S. dollar as the world’s major reserve currency,” Harper said. “Other than you know gold, bitcoin [and] a whole basket of things, right? I think you’ll see that the number of things that people use as reserves will expand, but the U.S. dollar will still be the bulk of it.”

Comment 2