The People’s Bank of China (PBoC) has said that bubbles in blockchain-based financing are “obvious” and has called upon the government to strengthen supervision in this area, Reuters reported.

The central bank has published a working paper today which studies blockchain's economic functions.

The paper particularly focuses on the new wave of “tokenization” brought about by blockchain technology. It categorizes major blockchain applications according to how they use tokens and discusses relevant economic problems such as tokens' monetary features, tokens' impacts on platform projects, blockchain's governance functions, and the performance and security of blockchain systems.

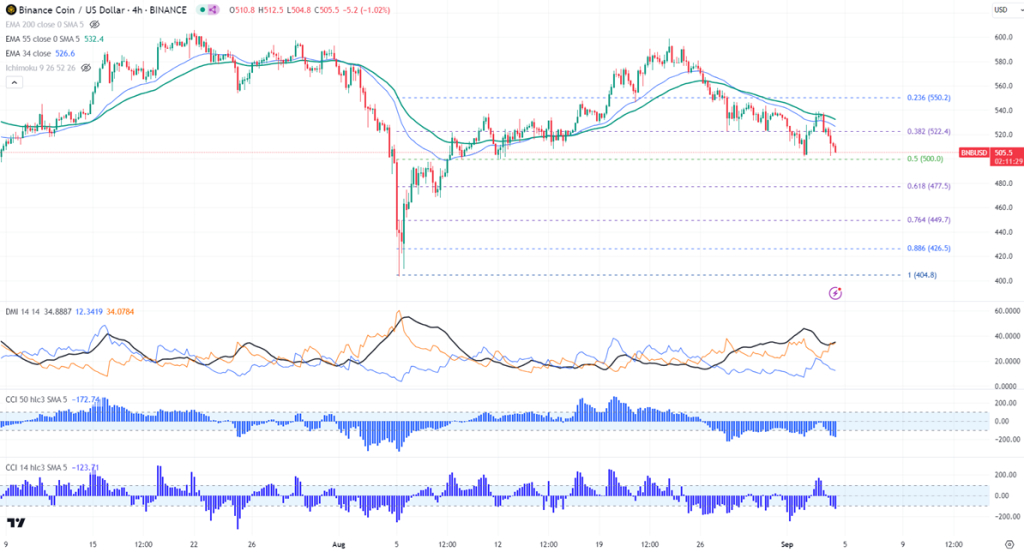

“Because it is difficult to accurately assess the intrinsic value of Token based on fundamentals, such applications can only refer to Token's price in the secondary market, but Token prices tend to show high volatility, limiting the development of such applications,” according to the working paper (via online translation).

The central bank said that speculation, market manipulation and other irregularities in blockchain-related investment and financing are common in the country.

The release of the working paper follows the recently issued financial stability report for 2018 in which the PBoC has highlighted the growth in disguised initial coin offering (ICOs) including airdrops in the country.

Comment 0