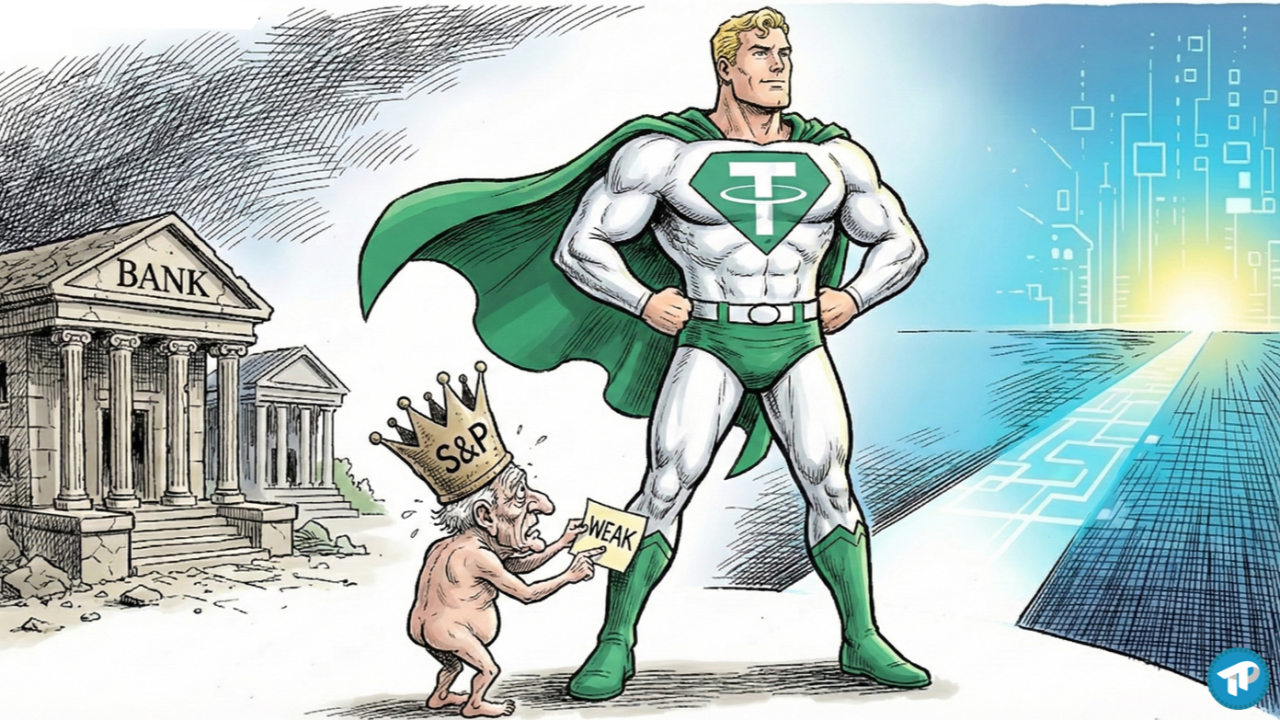

The recent war of words between S&P Global and Tether isn’t just corporate drama. It is the sound of tectonic plates shifting in the global financial landscape.

When S&P downgraded Tether (USDT) to a "weak" rating—effectively junk status—Tether CEO Paolo Ardoino didn’t issue a polite corporate retraction. He fired back, stating, "We wear your loathing with pride."

to S&P regarding your Tether rating:

— Paolo Ardoino 🤖 (@paoloardoino) November 26, 2025

We wear your loathing with pride.

The classical rating models built for legacy financial institutions, historically led private and institutional investors to invest their wealth into companies that despite being attributed investment grade…

At TOKENPOST, we viewed this exchange not as a simple dispute over collateral, but as a fundamental clash between "Old Money" gatekeepers and the emerging "New Money" reality.

S&P applied traditional banking metrics to a digital asset behemoth, flagging Bitcoin holdings in reserves as a primary risk. By analog standards, perhaps. But viewing digital financial innovation solely through an outdated lens misses the bigger picture.

Consider the reality of Tether today:

- A market cap exceeding $180 billion.

- US Treasury holdings that rival sovereign nations.

- Unprecedented operational efficiency and profitability per employee compared to legacy banks.

- A vital financial lifeline for millions in high-inflation economies where local currency has failed.

We must recall that these legacy rating agencies are the same institutions that stamped "AAA" on toxic financial products in 2008, blinding the market to systemic risk. Their complex models failed then; why should we assume their models for an entirely new asset class are infallible now?

Ardoino’s defiance stems from confidence. It is the confidence that the financial paradigm is shifting irreversibly. When legacy institutions label innovation as heretical simply because it doesn't fit their historical models, they risk becoming the "emperors with no clothes"—clinging to fading authority while the world moves on.

Tether certainly faces challenges in transparency and regulation that it must address. But the core issue here is clear: You cannot measure the future with yardsticks from the past.

The question isn't if digital finance will overtake traditional systems, but when. Legacy finance needs to adapt to this new reality, rather than trying to regulate it out of existence through outdated ratings.

What are your thoughts? Is traditional finance underestimating the resilience of stablecoins like Tether, or are the risk warnings valid?

Comment 0