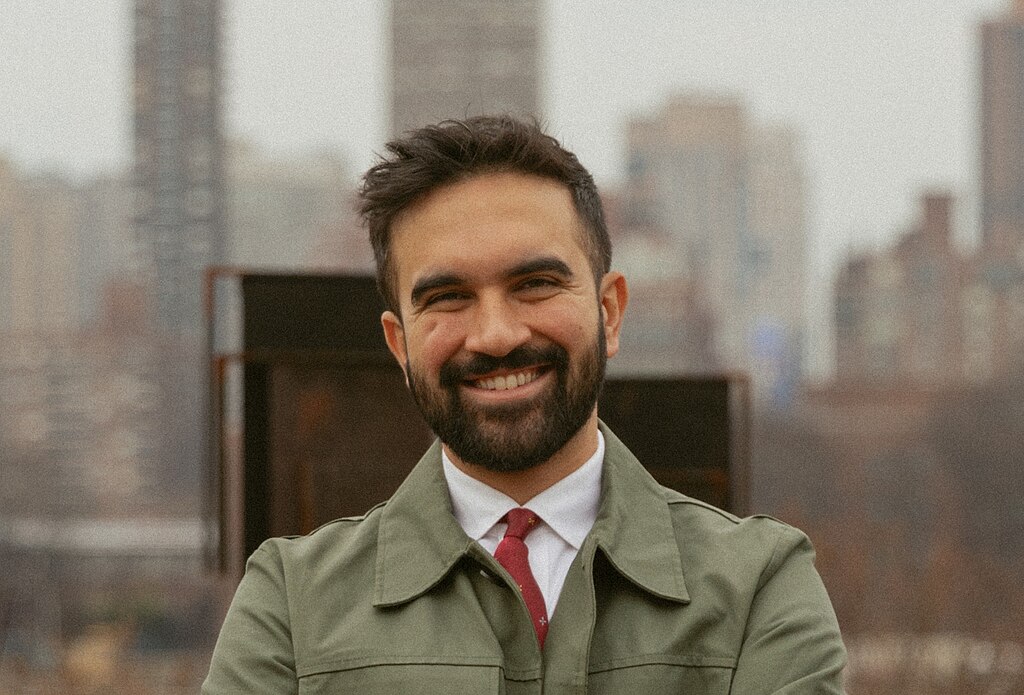

Zohran Mamdani’s stunning victory over former Governor Andrew Cuomo to become New York City’s 111th mayor has set off a wave of excitement — both politically and financially. The election drew record voter turnout and fueled unprecedented activity on prediction market platform Polymarket, generating more than $424 million in betting volume.

Among the biggest stories from the event was the staggering loss of a trader known as “fuxfux007,” who reportedly lost $969,169 after betting against Mamdani. According to Polymarket Analytics, the user appeared new to the platform, placing only two major wagers — one massive bet against Mamdani worth $973,757, and a much smaller one in his favor worth $42,973.

On the other hand, the night’s biggest winner, a trader operating under the handle “debased,” took home $188,487 by betting on Mamdani’s victory. The results confirmed Polymarket’s predictive accuracy, which closely mirrored pre-election polling data.

However, the platform faced renewed controversy when billionaire Bill Ackman alleged that certain participants manipulated markets to falsely inflate Mamdani’s odds. The claims echoed earlier debates surrounding last year’s U.S. election, when large trades by a French investor briefly distorted Donald Trump’s chances.

Experts and analysts dismissed these accusations, explaining that Polymarket’s decentralized structure and professional arbitrage activity quickly correct any artificial price shifts. Many traders even saw late bets on Mamdani as a “guaranteed bond” offering about 5% returns, highlighting confidence in the market’s integrity.

With Polymarket once again proving its ability to forecast real-world outcomes, Mamdani’s victory not only reshaped New York City’s political landscape but also underscored the growing legitimacy of blockchain-based prediction markets as powerful tools for gauging public sentiment and electoral outcomes.

Comment 0