The second day of Aptos Experience 2025 at ZeroSpace in Brooklyn didn’t feel like a typical blockchain conference. It felt like a reckoning — a moment when the builders, investors, and dreamers of Web3 finally paused to ask not what they could build, but what should endure.

The industrial-chic space, flooded with light and filled with equal parts ambition and humility, seemed an apt metaphor for where crypto stands today: past the feverish hype of cycles, but still electric with possibility.

Shelby, and the Infrastructure of Permanence

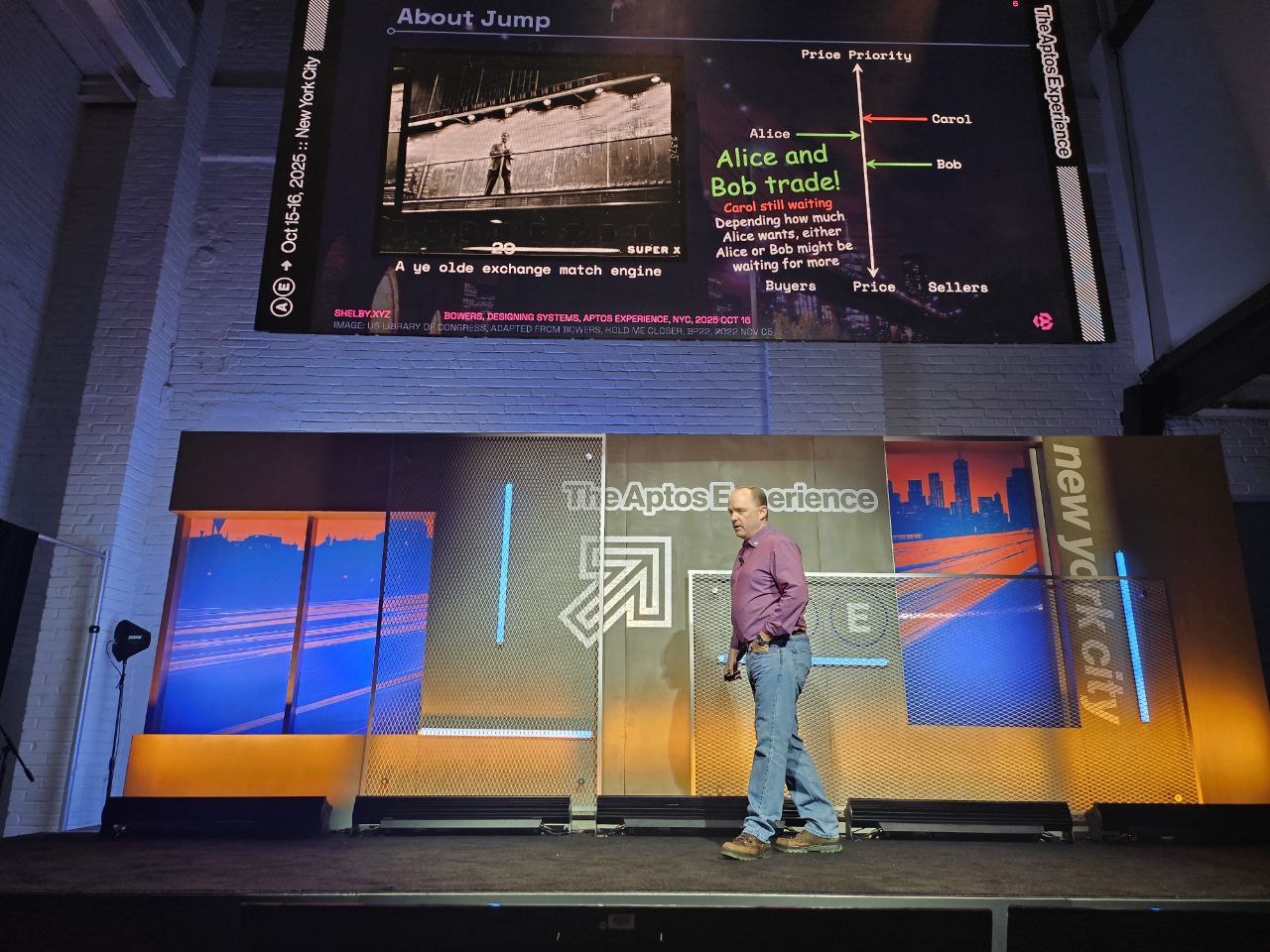

The morning opened with the Shelby Grand Showcase, a technical deep dive that played more like a masterclass in institutional design. Kevin Bowers, Chief Scientist at Jump Crypto, spoke of “systems that last,” framing infrastructure as something closer to public architecture than code.

“The measure of innovation isn’t speed,” he said. “It’s whether your system still works when nobody’s looking.”

From Austin Federa of DoubleZero came a case study in data gravity — how Shelby’s backbone, powered by decentralized computation, is designed not for scale alone, but for stability under pressure.

Greg Reed of NBCUniversal, who joined later for a fireside chat, gave the day one of its most memorable lines: “Culture will not migrate to Web3 just because the rails are better. It will move when stories move.”

In that moment, it became clear: Shelby wasn’t just another protocol. It was a symbol — of crypto’s search for endurance in a world of disappearing attention.

“Nobody Asked for That” — The Return of the User

By midday, the tone shifted from builders to users. The panel “Nobody Asked for That: What Users Actually Want” hit a nerve with founders and product managers who have grown weary of feature-first thinking.

Parth Chadha (STAN) cut through the noise: “We don’t have a product problem. We have an empathy problem.”

Kara Miley (Serotonin) expanded the point, describing how too many teams mistake tokenomics for retention. “Your user doesn’t care about your yield curve,” she said. “They care about whether they belong in your world.”

It was the day’s recurring theme — technology as infrastructure for emotion, not replacement for it. The best products, speakers agreed, are not those that innovate most visibly, but those that quietly restore trust.

USD1 and the Logic of Liquidity

When Ash Pampati (Aptos Foundation) sat down with Justin Kugel (WLFI) for an afternoon fireside chat, the conversation took a pragmatic turn: the politics and mechanics of money on-chain.

Ash described USD1, Aptos’s rapidly expanding stablecoin, as “high-velocity money” — designed less for yield farming and more for sustained transactional utility. “Sticky users matter more than spiky numbers,” he said.

He spoke with the calm conviction of a central banker. “We’re not here to print incentives,” he added. “We’re here to print confidence.”

That single phrase — print confidence — summed up the entire subtext of the conference: crypto’s most enduring projects are no longer the ones shouting the loudest, but the ones building quietly under regulatory light, treating compliance not as compromise but as architecture.

Investors in Reflection — “Where’s the Alpha?”

By mid-afternoon, the mainstage filled for one of the most anticipated sessions: “Where’s the Alpha? Inside the Minds of Top Crypto Investors.”

The panel — Diego Perez de Ayala (Frictionless Capital), Diogo Mónica (Haun Ventures), Tom Schmidt (Dragonfly), and Kevin Kelly (Delphi Digital) — delivered the kind of sober clarity that only comes after years of volatility.

“The real alpha,” one said, “is surviving long enough to compound wisdom.”

They spoke of cycles not as trading seasons but as human experiences — times to learn patience, to rediscover fundamentals. The message was clear: liquidity may dry up, but conviction compounds.

As the panel turned to exit strategies, talk of IPOs, M&A, and equity-based funding filled the air. The token, once treated as the only exit, was now just one of several paths. The industry’s adolescence was ending; governance, regulation, and long-term capital were stepping in.

Tokens, IPOs, and the New Public

The final mainstage session, “Tokens, IPOs, and Tier 1s,” brought the day full circle. Baek Kim (Hashed), Claire Zhao (Hyperion), and Ryan David Williams (Ashbury Legal) explored what it really means to “go public” in 2025.

For Zhao, whose company launched its token on Binance Alpha earlier this year, the on-chain debut was less an exit than a beginning. “Going public,” she said, “means going on-chain.”

She spoke of economic alignment — traders in Seoul, developers in Lisbon, and users across the globe bound by a single programmable incentive system. “It’s a beautiful chaos,” she smiled, “but it’s the future of public ownership.”

Williams, the lawyer on stage, grounded the optimism in legal realism. “There’s no one-size-fits-all structure,” he said. “The right path depends on how — and where — value truly accrues.”

And Baek Kim, closing the discussion, offered the most human observation of the day: “In crypto, capital grows exponentially. People don’t. Founders have to catch up to their own valuation.”

It drew knowing laughter — and quiet nods.

A Day That Felt Like a Turning Point

By sunset, as the crowd stepped out from ZeroSpace onto the quiet, brick-lined stretch of Butler Street, the mood was unmistakable. Aptos Experience had outgrown its own name. This wasn’t merely an “experience” anymore — it was a statement of purpose.

Crypto’s builders no longer felt like rebels working from the margins. They looked — and sounded — like architects of a new financial and cultural order, one defined not by speculation but by endurance, precision, and accountability.

As twilight deepened, the conversations migrated across the river — to The After Experience at Chinese Tuxedo, a century-old Chinatown restaurant in Manhattan where the day’s intensity softened into celebration. Over shared plates and soft laughter, the builders of Web3 traded code for conversation, ambition for reflection.

If Day 1 was about ambition, Day 2 was about adulthood. And as one veteran investor murmured on the way out,

“For the first time in a long time, it feels like we’re not chasing the future. We’re finally building it.”

Comment 0