Korea’s cryptocurrency market has entered a new phase — more regulated, data-driven, and internationally relevant than ever before. Once known for retail speculation, the country has evolved into one of the most structured and compliant digital-asset ecosystems in the world.

Market Expansion Amid Global Slowdown

According to the Financial Intelligence Unit (FIU) and the Financial Supervisory Service (FSS), Korea recorded 10.77 million active trading users in the first half of 2025 — an 11% increase from the previous year.

The domestic digital-asset market maintained its scale despite global headwinds, with a total market capitalization of ₩95.1 trillion (≈ US$70 billion) and an average daily trading volume of ₩6.4 trillion (≈ US$4.7 billion) across 17 licensed exchanges.

Meanwhile, ₩6.2 trillion (≈ US$4.6 billion) in KRW deposits underscores the market’s depth, supported by a 13% year-on-year increase in listed tokens to 1,538 assets.

The data also shows a steady demographic shift. Men in their 30s and 40s account for over half of all traders, while 18% of users hold digital assets worth more than ₩10 million (≈ US$7,400) — an indication of growing asset diversification and higher confidence among investors.

Upbit’s Accelerated Listing Strategy

Korea’s largest exchange, Upbit, has been the key driver of market activity this year.

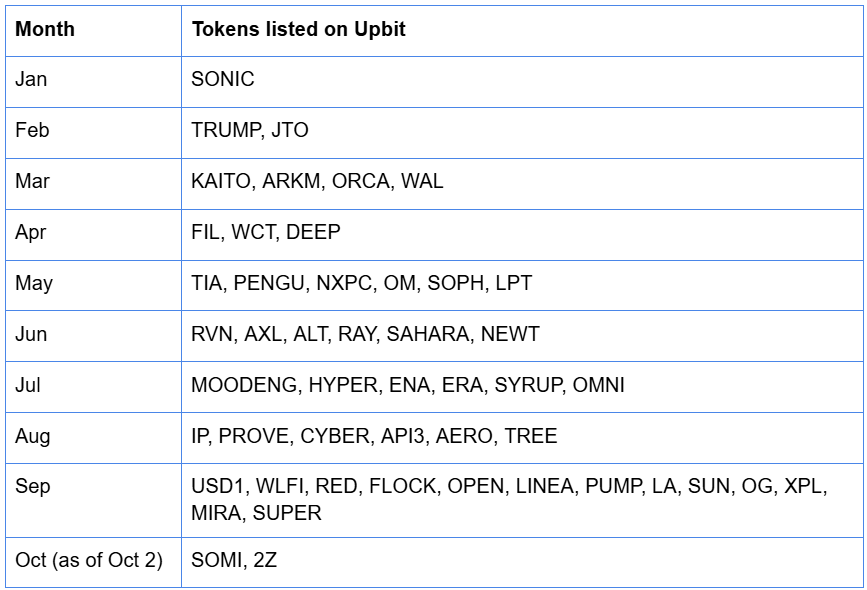

From January through early October 2025, Upbit listed 49 new tokens, 45 of which were paired with the Korean won — nearly three times the pace of 2024.

September alone saw 13 new listings, further solidifying Upbit’s dominance in domestic liquidity and its role as a gateway for global projects seeking exposure to the Korean market.

The timing aligns with Naver’s pending acquisition of Dunamu, Upbit’s parent company — a move that could integrate Korea’s leading Web2 platform with its strongest Web3 infrastructure. Industry analysts expect this combination to accelerate mainstream adoption through on-chain features embedded across Naver’s ecosystem.

Structural Strength Beneath the Surface

Despite a 14% decline in total market capitalization compared to the previous half, Korea’s crypto economy remains fundamentally robust. The enforcement of the Virtual Asset User Protection Act, launched in mid-2024, has provided a clearer regulatory foundation for exchanges and institutions.

This balance of compliance and liquidity sets Korea apart. The country now hosts one of the world’s most active fiat-to-crypto markets, with retail and institutional investors coexisting under transparent oversight.

The Bigger Picture

Korea’s digital-asset sector represents more than market volume — it’s a blueprint for sustainable Web3 integration. Where other jurisdictions are still debating frameworks, Korea has already operationalized them, allowing innovation to coexist with consumer protection and financial stability.

For global builders, that makes Seoul not just a destination, but a launchpad for Asia’s next Web3 wave.

Comment 0