Stronger-than-expected U.S. employment and economic data have put downward pressure on the cryptocurrency market, with hopes for rate cuts in 2025 diminishing. Key economic indicators are sending mixed signals, rattling markets, and causing a steep pullback in crypto prices.

Bitcoin Retreats After Breaking $100K

Bitcoin, which had regained upward momentum early this year to surpass the $100,000 mark, saw its rally fizzle as stronger-than-expected U.S. economic data weighed on market sentiment.

The JOLTS report released by the U.S. Bureau of Labor Statistics revealed that November job openings surged to 8.09 million, significantly exceeding the previous month’s 7.83 million and the forecasted 7.70 million.

Additionally, the ISM Manufacturing PMI for December came in at 54.1, beating the previous month's 52.1 and the expected 53.3. Meanwhile, the ISM Non-Manufacturing Prices Index soared to 64.4, surpassing both the previous record of 58.2 and the forecasted 57.5.

Although these indicators are not traditionally market-moving, their strong readings have compounded concerns about the macroeconomic outlook, unsettling an already fragile bond market.

Market Impact

The yield on the benchmark 10-year U.S. Treasury note rose 5 basis points to 4.68%, nearing multi-year highs. The rise in bond yields further spooked equity markets, with the Dow Jones Industrial Average slipping 0.42%, the S&P 500 falling 1.11%, and the Nasdaq Composite dropping 1.89% by the close of trading.

Cryptocurrencies were hit even harder. Bitcoin dropped over 5% to $96,100, erasing gains from the previous day when it briefly climbed above $102,000. Major altcoins saw sharper declines:

- Ethereum and Solana fell over 7%.

- Dogecoin, Chainlink, and Avalanche posted losses of 9-10%.

The selloff triggered liquidations of approximately $300 million in long positions, marking the year’s first significant leveraged wipeout.

Dimming Rate Cut Prospects

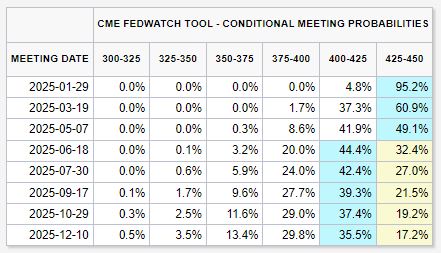

The robust economic data have further diminished the likelihood of interest rate cuts in 2025. Markets have already priced out the possibility of a rate cut in January, with CME FedWatch showing a 95.2% probability of the Federal Reserve maintaining current rates.

Expectations for a March rate cut have dropped to 37.3%, down from 50% just a week ago, while the probability of a rate reduction in May has fallen to 49.1%.

Kyle Chapman of Barringer Group commented, "Investors are now pricing in only a single 0.25 percentage point rate cut for this year."

Outlook

The stronger-than-expected economic performance has dampened bullish sentiment in the cryptocurrency market, which has thrived in an environment of accommodating monetary policy. With rate-cut expectations pushed further out, cryptocurrencies face increased headwinds in the near term.

For Bitcoin and other digital assets, the road to sustained recovery may depend on clearer signs of easing monetary conditions and improved macroeconomic stability. Until then, heightened volatility and cautious sentiment are likely to define the market.

Comment 0